LLC fees hurt low-income entrepreneurs

The Illinois Senate passed Senate Bill 2776 to lower the cost to create a Limited Liability Company to $39 from $500. This piece of legislation, which rightfully received bipartisan support, will take effect immediately upon receiving Gov. Pat Quinn’s signature. LLC fees are unnecessary and harm low-income entrepreneurs. In fact, LLC fees function like a...

The Illinois Senate passed Senate Bill 2776 to lower the cost to create a Limited Liability Company to $39 from $500. This piece of legislation, which rightfully received bipartisan support, will take effect immediately upon receiving Gov. Pat Quinn’s signature.

LLC fees are unnecessary and harm low-income entrepreneurs.

In fact, LLC fees function like a regressive tax, which is a tax that takes a higher percentage of lower incomes.

Right now, the fee to create an LLC is $500, plus a $250 annual filing fee. In addition, there is a laundry list of other fees that some LLCs have to pay. These are state-imposed hurdles to entrepreneurial success.

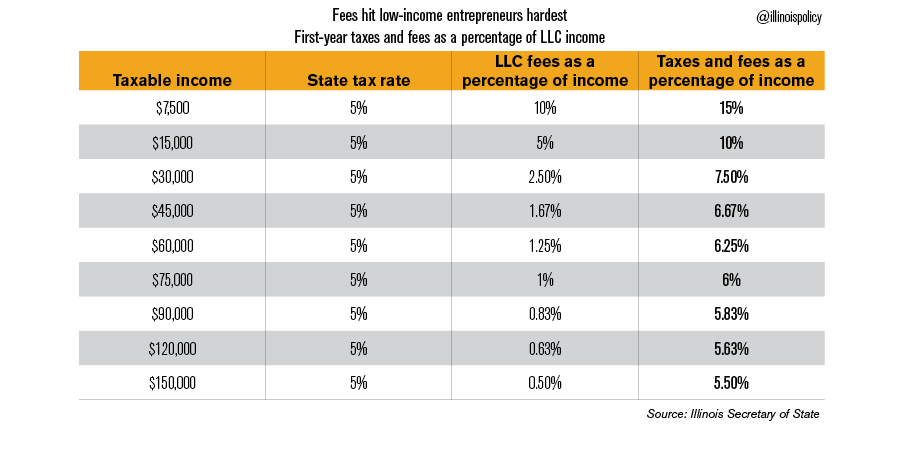

LLC income is taxed under the state’s fair, flat tax rate. But a new LLC must pay an additional $750 in fees in its first year. This can be a significant portion of income and working capital for entrepreneurs, especially ones that start near break-even.

The chart below shows how LLC fees distort Illinois’ fair, flat tax system by taking a higher percentage from low-income entrepreneurs. The lower the income, the higher the fee is as a percentage.

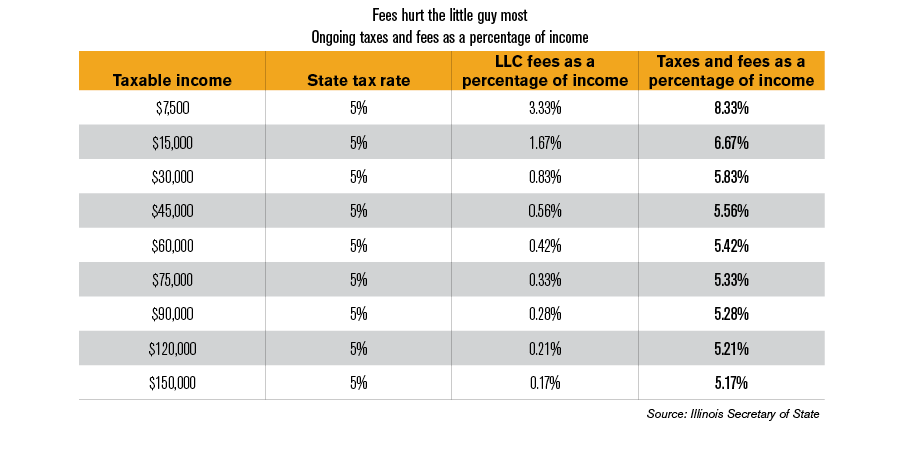

After the first year, LLCs are still subject to the $250 annual filing fee. This fee is not reduced by SB 2776. This filing fee is like charging taxpayers to file their taxes. It should be eliminated or greatly reduced.

LLC fees hurt low-income entrepreneurs, and are a useful model for understanding the effect of fees and regulations on small businesses.

Like LLC fees, most regulations place a heavier burden on smaller businesses. Illinois’ regulatory burden is ranked ninth-worst nationally. That contributes directly to Illinois’ 12th-worst ranking for entrepreneurship.

Chicago has a strangling regulatory field, which contributes to its third-worst ranking for entrepreneurship amongst the country’s 15 largest cities.

Illinois businesses, especially the smallest ones, should not be treated like piñatas. LLC fees should be eliminated. And these cuts should serve as a model for reducing licensing and regulation to the absolute minimum necessary to ensure public safety.