Indiana-Illinois border war

Indiana cut taxes again last week. And it gained another Illinois business. On Thursday, Indiana cut business taxes, including a reduction in the corporate rate. That came on the heels of AM Manufacturing Co.’s announcement that it will move from Illinois to Indiana. AM Manufacturing Co. is a family-owned machine manufacturer. AM Manufacturing will move...

Indiana cut taxes again last week. And it gained another Illinois business.

On Thursday, Indiana cut business taxes, including a reduction in the corporate rate. That came on the heels of AM Manufacturing Co.’s announcement that it will move from Illinois to Indiana.

AM Manufacturing Co. is a family-owned machine manufacturer. AM Manufacturing will move from Dolton, Ill., to Munster, Ind. The new facility will be double the size of the Dolton facility, indicating that the company plans to grow.

Let’s look at this from AM Manufacturing’s perspective.

When a manufacturer decides on a new location, they have to look at costs such as workers’ compensation. According to the 2012 Oregon Workers’ Compensation analysis, Indiana has the second-best premium rate nationally, while Illinois is 47th-best. The comparison:

Indiana: Second-best, at $1.16 per $100 of payroll.

Illinois: 47th-best, at $2.83 per $100 of payroll.

AM Manufacturing stands to save tens of thousands of dollars annually on workers’ compensation alone.

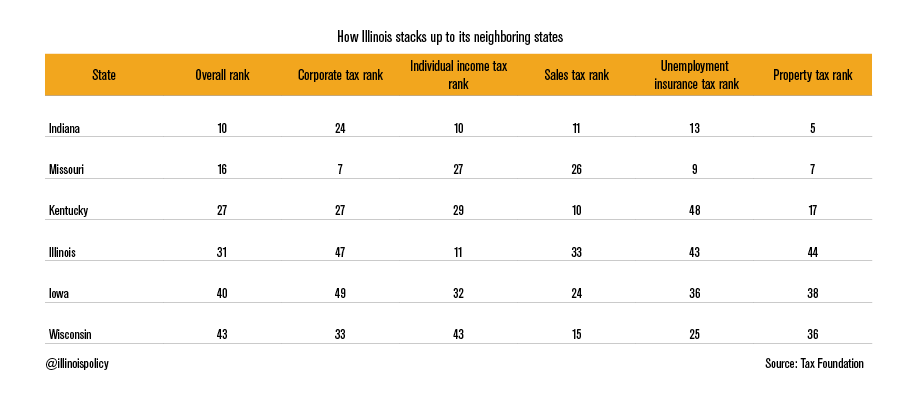

Property taxes, incomes taxes and unemployment insurance rates are other costs for manufacturers. Tax Foundation data give more evidence why Illinois companies are crossing borders, and in particular why Indiana is so appealing.

Indiana passed legislation to improve its area of relative weakness, the corporate tax rate. Legislators passed the law by overwhelming majorities. Rates are already scheduled to drop to 6.5 percent by 2016. The law extends the annual reduction to 4.9 percent by 2022. The legislation also empowers counties to lower or eliminate taxes on business property.

Illinois’ greatest strength is its flat individual income tax rate, which legislators are threatening to swap out for a progressive tax. The Tax Foundation has assessed that such a move will drop Illinois’ income tax ranking from to 33rd from 11th, while Illinois’ overall ranking would fall to 44th from 31st.

Looking at the states from the perspective of a business owner highlights the need for economic reform in Illinois. Workers’ compensation, unemployment insurance, corporate taxes and property taxes need to be reformed to treat businesses as sources of jobs and growth rather than sources of revenue.