Texas surpasses Illinois in median household income

The common refrain made against Texas by those who defend the status quo in Illinois is that the jobs being created in the Lone Star State are lower-paying and less-rewarding opportunities. But not anymore. Texas is now unquestionably besting Illinois in providing for the middle class. According to the U.S. Census Bureau, in 2012 the inflation-adjusted...

The common refrain made against Texas by those who defend the status quo in Illinois is that the jobs being created in the Lone Star State are lower-paying and less-rewarding opportunities.

But not anymore. Texas is now unquestionably besting Illinois in providing for the middle class.

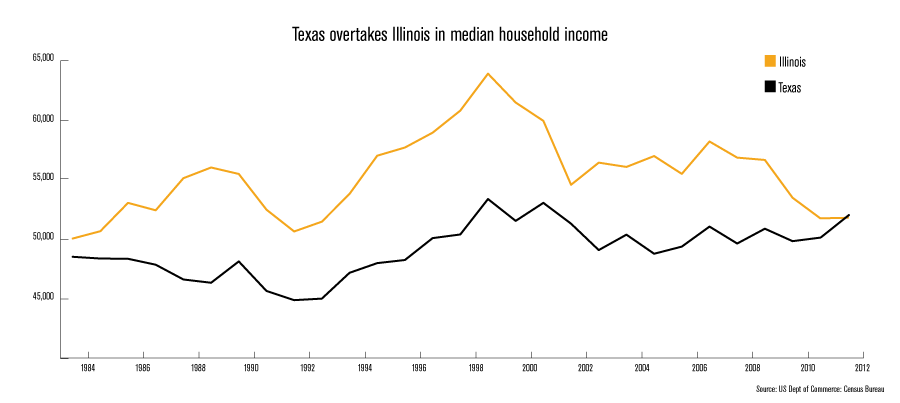

According to the U.S. Census Bureau, in 2012 the inflation-adjusted median household income for Texas surpassed that of Illinois for the first time since 1984, when the statistic first started being recorded.

That means the household making the median income in Texas is taking home a bigger paycheck than the household making the median income in Illinois.

Not only is the pay higher, but Texans also get to keep more of it. After taking the standard deduction for three household members, the median Illinois household pays $2,287 in state income taxes. The median Texas family pays no income tax, as work is not taxed in Texas.

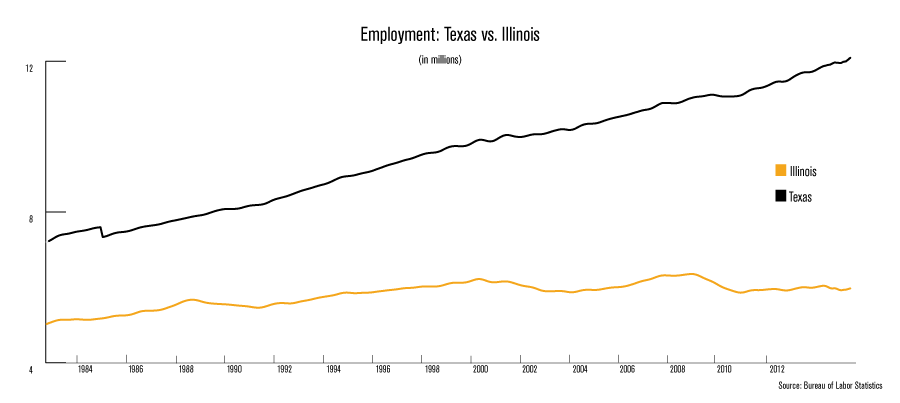

And not only is work not taxed in Texas, but there is also a lot more work to be had. Since 1984, Texas has created nearly 5 million new employment opportunities. Illinois created less than 1 million.

This story isn’t a simple comparison, it’s also a transfer. From 1995-2010, Illinois had a net loss of nearly 33,000 households representing just less than 80,000 people to net out-migration to Texas alone. In terms of dollars, Illinois lost $1.98 billion in taxable income to Texas, or $60,500 per household lost.

Ironically, Illinois’ anti-business, anti-success policies can take partial credit for Texas’ success.