Cut the laundry list of fees for LLCs

Imagine creating a new solution, devising an innovative new product, providing an effective service or simply doing something well enough that you can build a business. Your dream has come true, and you’re ready to start out on your own. As a small-business owner, you want to utilize the advantages of the Limited Liability Company,...

Imagine creating a new solution, devising an innovative new product, providing an effective service or simply doing something well enough that you can build a business. Your dream has come true, and you’re ready to start out on your own.

As a small-business owner, you want to utilize the advantages of the Limited Liability Company, or LLC, structure. It allows you to avoid corporate taxation, but protects your personal assets from litigation. It’s perfect for you.

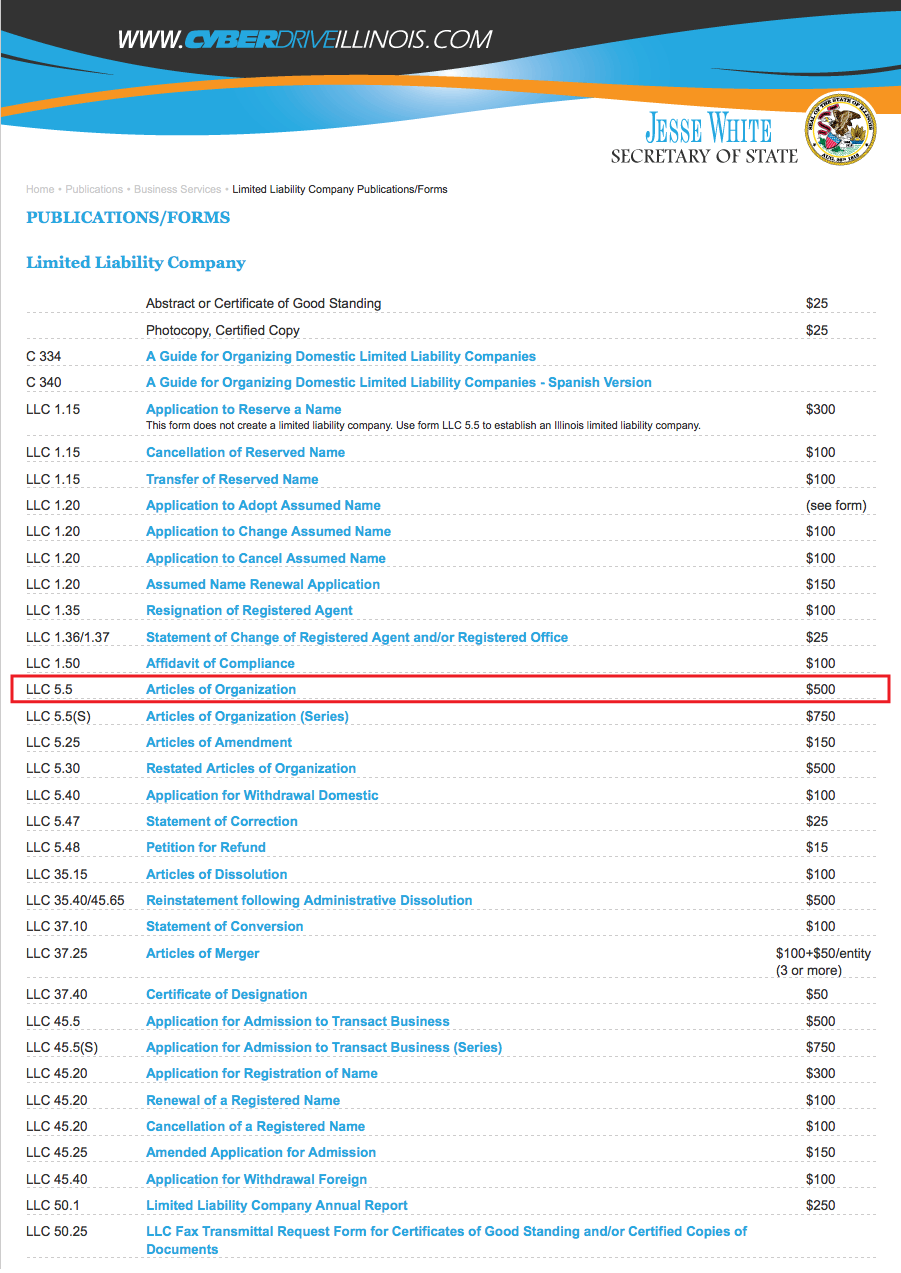

You sign on to the Illinois Secretary of State’s webpage and see a laundry list of 32 possible fees to navigate through. All new LLCs have to pay a combination of these fees, some one-time and others recurring. The combined cost of all possible fees is nearly $6,500.

To file Articles of Organization to start an LLC, Illinoisans must pay the nation’s second-highest fee of $500. In last week’s State of the State address, Gov. Pat Quinn proposed cutting that fee to $39. This change would help new businesses retain precious growth capital, and is the right thing to do for Illinois entrepreneurs.

Complying with the state’s onerous regulations is difficult enough. Quinn should make good on his promise and then expand his cuts to include all LLC-associated fees. The cost to file for an LLC, along with all other LLC fees, should be eliminated or cut to Quinn’s proposed $39 or lower. Illinois should make it cheap and simple to create opportunities for the jobless.