Top 10 facts about the proposed progressive tax hike

Top 10 facts about the proposed progressive tax hike The beginning of 2014 marked an important milestone for Illinois taxpayers: we are just one year away from tax relief. Illinois taxpayers currently fork over 5 percent of their paycheck to the state. The good news is Illinois’ income tax rate is slated to drop to...

Top 10 facts about the proposed progressive tax hike

The beginning of 2014 marked an important milestone for Illinois taxpayers: we are just one year away from tax relief.

Illinois taxpayers currently fork over 5 percent of their paycheck to the state. The good news is Illinois’ income tax rate is slated to drop to 3.75 percent in January 2015. Illinois’ sky-high business taxes are scheduled to decrease as well. It’s long-awaited and welcome news for our economy.

But there are a group of lawmakers and special interest groups that don’t want to let that happen. Instead, their plan is to increase taxes again by swapping out the state’s constitutionally protected flat-rate income tax for a progressive income tax.

Here are the facts on the progressive income tax in Illinois:

1. Several special interest groups and lawmakers in Illinois are pushing to increase taxes by swapping out the state’s constitutionally protected flat-rate income tax for a progressive income tax. Advocates for higher income taxes try to disguise the tax hike as something it isn’t.

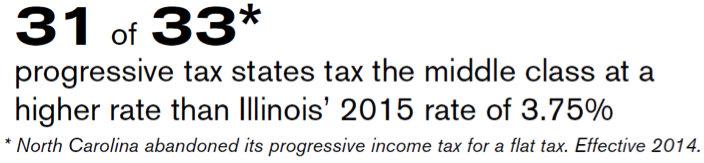

2. Thirty-one of 33 progressive tax states tax the middle class at a higher rate than Illinois’ 2015 rate of 3.75 percent (North Carolina abandoned its progressive income tax for a flat tax earlier this year).

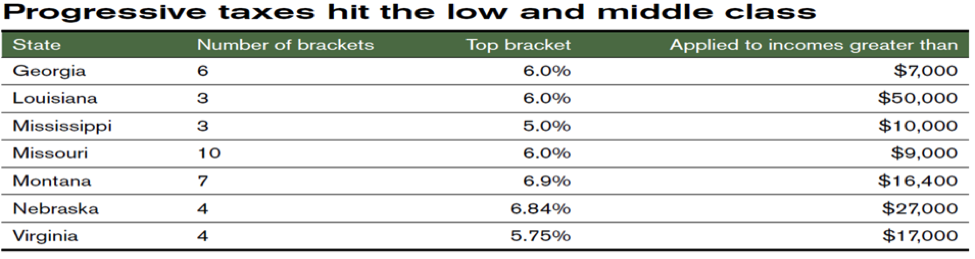

3. Progressive tax states often have top marginal tax rates that hit middle-and low-income earners. Consider the following examples:

4. Between 2001 and 2011, the nine states with no income tax outperformed the nine states with the highest income taxes in population growth, Gross State Product growth, nonfarm payroll employment, and state and local tax revenue.

5. The nine states with no personal income tax gained $113.17 billion in adjusted gross income between 2000 and 2010; the nine states with the highest personal income tax rates lost $90 billion over the same period.

6. Progressive income tax structures cause wild swings in revenue. When times are good, revenues rise. But when economic slowdowns occur, revenues plummet and that hurts the very people who are most vulnerable: the poor who are receiving help from government.

7. Illinois had the 17th most competitive tax climate for businesses just a few years ago. But the state’s rank plummeted 14 spots in the Tax Foundation’s “State Business Climate Index,” to 31st from 17th, after Illinois lawmakers passed a record tax increase on individuals and businesses in 2011. Illinois’ ranking would take a second tumble if lawmakers pass a progressive income tax plan that has been proposed. According to the Tax Foundation, a progressive income tax would drop Illinois’ business tax climate ranking down to 44th.

8. Illinois doesn’t have a revenue problem; it has a spending problem. Illinois has more revenue than it ever has, and spending has outpaced growth in population and inflation by 3-to-1.

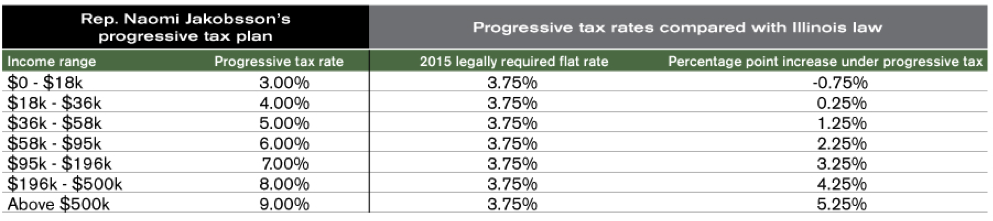

9. Under current Illinois law, the individual income tax rate will be 3.75 percent in 2015. Under state Rep. Naomi Jakobsson’s new plan, however, a higher 4 percent rate kicks in for people earning just $18,000. That income tax rate targets Illinois’ working class.

10. Illinois taxpayers already pay the nation’s ninth-highest state and local tax burden per capita.