Fighting the progressive tax in Illinois

Fighting the progressive tax in Illinois The battle to raise taxes again is underway in Illinois. Politicians and special interest groups across the state have put a plan in motion to implement yet another income tax hike in Illinois – one that targets the state’s working- and middle-class residents. Politicians already pushed through a record...

Fighting the progressive tax in Illinois

The battle to raise taxes again is underway in Illinois. Politicians and special interest groups across the state have put a plan in motion to implement yet another income tax hike in Illinois – one that targets the state’s working- and middle-class residents.

Politicians already pushed through a record income tax increase in 2011. The problem is they failed to keep any of the promises they attached to that tax hike. Now, instead of being held accountable for those failures, they want to push taxes even higher in Illinois.

Here are the details on what’s happened so far:

The “secret plan” turned into legislation

A little more than a year ago, one political news outlet in Illinois was trying to brush the progressive tax hike proposal under the rug, dubbing it some sort of make-believe “secret plan” to raise taxes.

But that secret plan materialized into two separate pieces of legislation (here and here) that were introduced during the 2013 spring legislative session.

Illinois House and Senate Republicans stand united against progressive tax

Illinois’ flat-rate income tax is protected in the state’s constitution. To swap out the flat-rate income tax for a progressive tax, the Illinois General Assembly would need to pass a constitutional amendment – requiring a supermajority vote (71 votes in the House and 36 in the Senate).

That means to stop a progressive tax in Illinois, 48 members in the House and 23 in the Senate would need to oppose the measure to prevent a supermajority vote.

Fortunately, the Republican caucus released this year a press release announcing that all the Republican members in the Illinois General Assembly publicly oppose a progressive tax.

With the support of one Democrat member in the House, 48 state Republicans in the House oppose the progressive tax – the number of members required to demonstrate that there is enough support to block a progressive tax in Illinois.

Illinois Policy Institute influencing the debate

The Illinois Policy Institute has relentlessly fought the progressive tax hike with policy reports, op-eds, blogs, digital strategy and events across the state. And it’s working.

Proponents of a progressive income tax in Illinois have publicly expressed their frustration with the impact that the Illinois Policy Institute is having on this debate. State Rep. Naomi Jakobsson issued a press release stating that “The Illinois Policy Institute is blanketing the state,” and complained about how effective we have been at countering the progressive tax message at every turn.

Progressive tax rates endorsed

Special interest groups teamed up with lawmakers to convince Illinoisans to vote for a progressive income tax without knowing what the rates will be.

Asking lawmakers to decide on the tax rates later on is sort of like buying a car and letting the dealer decide the interest rate on your auto loan after you’ve already signed the paperwork – you never know what you’ll end up paying.

But not committing to tax rates was a strategic move. It allowed tax-hike advocates to sell their proposal as something it wasn’t – a tax cut.

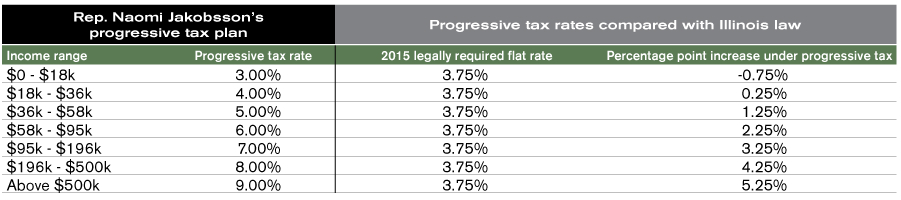

In October 2013, Jakobsson finally endorsed a rate structure. The income tax rate in Illinois is legally required to sunset to 3.75 percent in 2015. Under Jakobsson’s plan, a higher 4 personal marginal rate kicks in for people earning more than $18,000. Marginal rates increase again to 5 percent after $36,000, to 6 percent after $58,000 and again to 7 percent after $95,000. These rates attack Illinois’ working and middle classes.

Sign the petition

The Illinois Policy Institute launched an anti-progressive tax petition online. The petition has received more than 4,500 signatures.

The progressive tax debate will most certainly continue in 2014. Lawmakers will try to pass a progressive tax and put it on the ballot for the fall election. But make no mistake – a progressive income tax would be a disastrous blow to Illinois’ already struggling economy. Taxpayers must work together to stop the next Illinois tax hike.