The progressive income tax: unfair, unstable, unresponsive and inefficient

Gov. Pat Quinn and many groups in Illinois are pushing for the state’s next multibillion dollar tax increase – a progressive income tax. Passing a progressive income tax is “one of my goals before I stop breathing,” Quinn said. There has been a lot of misinformation about the progressive income tax floating around. It’s time to...

Gov. Pat Quinn and many groups in Illinois are pushing for the state’s next multibillion dollar tax increase – a progressive income tax.

Passing a progressive income tax is “one of my goals before I stop breathing,” Quinn said.

There has been a lot of misinformation about the progressive income tax floating around. It’s time to set the record straight. Our recent paper, Progressive income tax: Money grab disguised as tax reform, makes clear that a progressive income tax would have detrimental effects on Illinois’ taxpayers and the state’s economy.

Here is the truth behind four common progressive tax myths:

Myth #1: the progressive income tax is fair

Fact: A progressive tax is discriminatory by its very nature because it purposefully taxes some people, and some dollars, at a different rate than others. In contrast, a flat tax treats everyone equally. Everyone in all income classes pay the same rate. Equal treatment is fair.

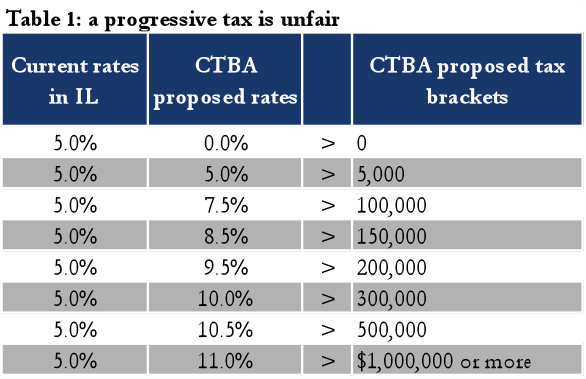

Under Illinois’ current flat rate income tax structure, all income earners pay a tax rate of 5 percent, which is required by law to sunset to 3.75 percent in 2015. Under the Center for Tax and Budget Accountability’s progressive income tax plan, individuals would be taxed using eight ever-higher marginal tax rates, topping off at 11 percent (Table 1).

Myth #2: the progressive income tax is stable during poor economies

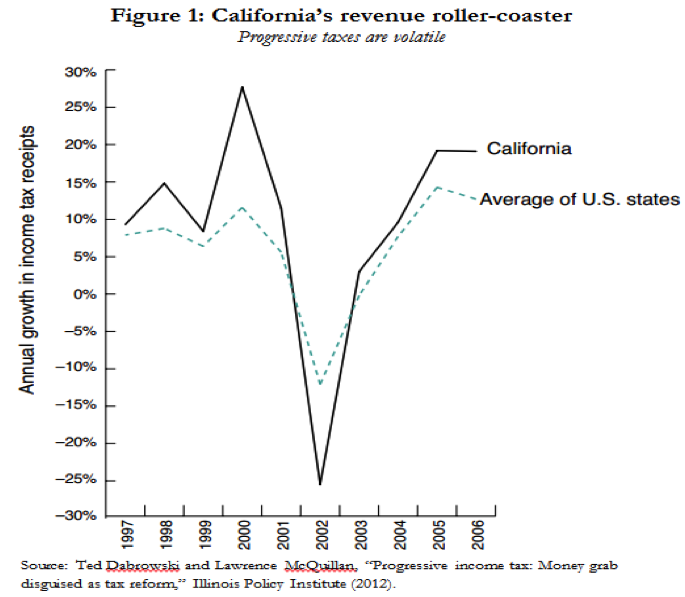

Fact: A progressive income tax is unstable. It exaggerates booms and busts in state revenue. During good times, people are pushed into higher marginal brackets and revenues grow. Politicians inevitably use the higher revenues to spend more and beef up existing government programs. But during bad times, revenue drops are magnified. This cycle is often referred to as the “revenue rollercoaster.” For example, see California’s revenue trends under the state’s steeply progressive tax structure.

Myth #3: the progressive income tax is responsive to a modern economy

Fact: In today’s economy, states without an income tax outperform high-tax states. During the past 10 years, nine states with no personal income tax had, on average, cumulative job growth more than 15 times greater. Population grew 112 percent more in the no-tax states and gross state product grew 36 percent more. No-tax states outperformed high-tax states across all measures.

Myth #4: the progressive income tax is efficient and doesn’t distort private markets

Fact: A progressive income tax provides a disincentive to work and it punishes success. Whether it’s an entrepreneur working her way out of her parent’s basement or an out-state businessman whose investment could create jobs in Illinois, a progressive tax structure is set up to take more of their income as their hard work begins to pay off.

Proponents of a progressive tax often argue that tax increases do not cause individuals to behave differently. But that argument ignores basic economic principles. People respond to incentives. If success is punished, fewer people will be successful. If growing a business is punished, fewer businesses will grow. If creating jobs becomes more expensive, fewer jobs will be created.

Ultimately, progressive taxes are contrary to sound tax policy because they penalize work effort, saving, investment, risk-taking, entrepreneurship and population in-migration – the ingredients of self-sustaining prosperity.