Illinois’ unfriendly business environment killing jobs, growth

A new Tax Foundation report reveals one of the reasons why Illinoisans are finding it so hard to get jobs – it’s getting more and more expensive for businesses to operate in Illinois. The Tax Foundation released today its 2014 State Business Tax Climate Index, confirming the state’s worsening position. Illinois has dropped 15 spots to...

A new Tax Foundation report reveals one of the reasons why Illinoisans are finding it so hard to get jobs – it’s getting more and more expensive for businesses to operate in Illinois.

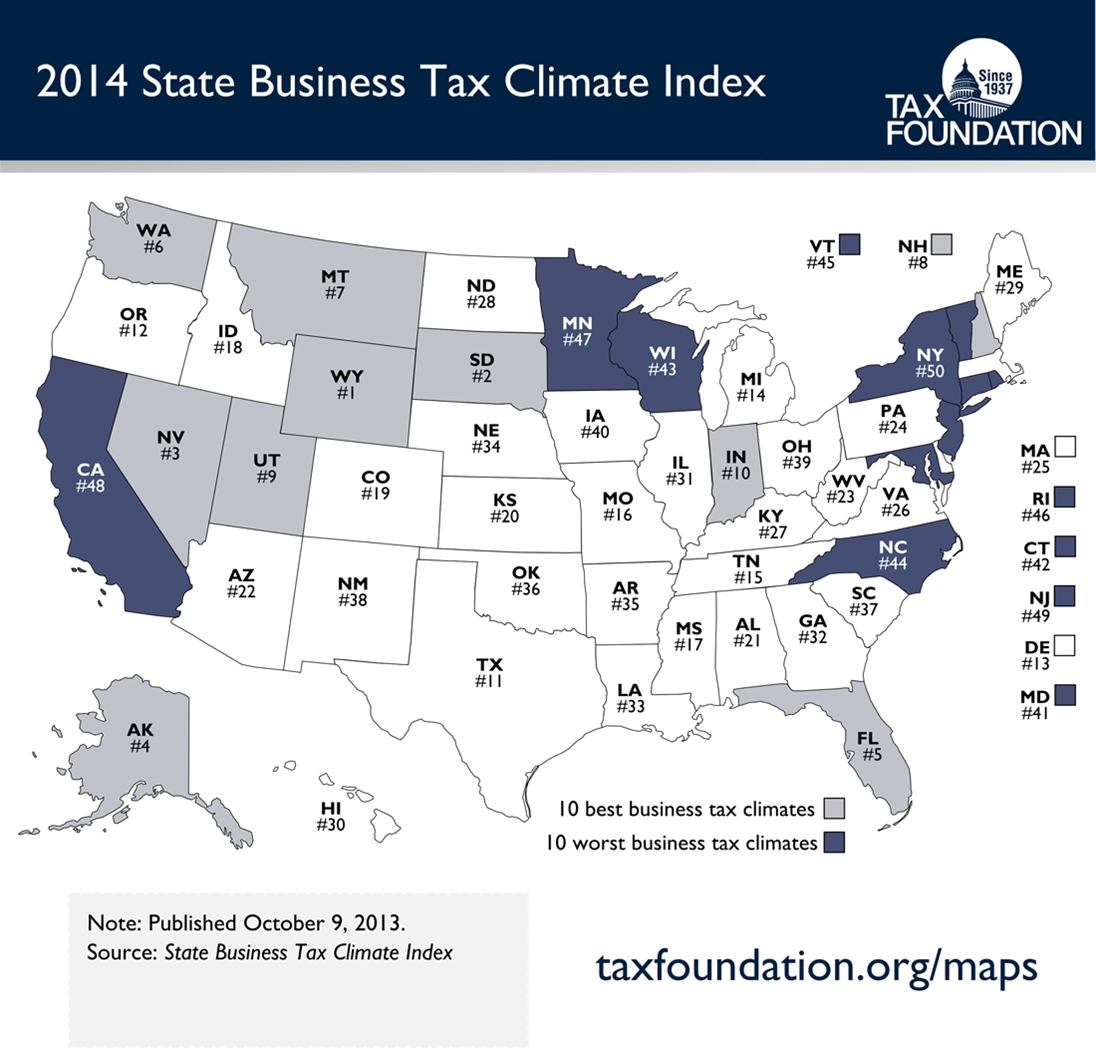

The Tax Foundation released today its 2014 State Business Tax Climate Index, confirming the state’s worsening position. Illinois has dropped 15 spots to 31st from 16th since 2011 – the year the state passed a record income tax hike. This lower ranking means it’s become even more difficult for businesses and entrepreneurs to compete in Illinois’ unfriendly tax environment.

The Tax Foundation ranks states based more than 100 different variables that fit into five broad categories: major business taxes, individual income tax, sales tax, unemployment insurance and property tax. Here’s how Illinois ranks relative to its neighboring states:

Illinois businesses and consumers are suffering – operating in a state that ranks 47th in corporate taxes, 33rd in sales taxes, 43rd in unemployment insurance and 44th in property taxes.

The only category propping up Illinois’ rank is the individual income tax (11th) which accounts for a third of the total index score. Illinois, Indiana and Michigan score well in this category because of their flat-rate income tax structure.

But several special-interest groups and lawmakers in Illinois are looking to eliminate Illinois’ only positive competitive characteristic. Their plan is to swap out Illinois’ constitutionally protected flat-rate income tax for a progressive income tax that would push income tax rates as high as 11 percent.

A progressive income tax increase would be the final blow to Illinois’ already-struggling economy – especially during a time when at least nine states are cutting taxes to better compete in today’s modern economy.

The Illinois model of high taxes and excessive state spending is not only failing the state’s successful businesses and entrepreneurs – but it’s also failing the state’s poor, disadvantaged and working class. A worsening business climate in Illinois means lost opportunities for the state’s residents.

More than 1 million Illinoisans are unemployed or underemployed. The state’s Medicaid rolls have nearly doubled since 1999. More residents are finding themselves added to the food stamp rolls than to payroll jobs. And those with the means to leave the state do. Illinois continues to experience a mass outmigration of wealth and people.

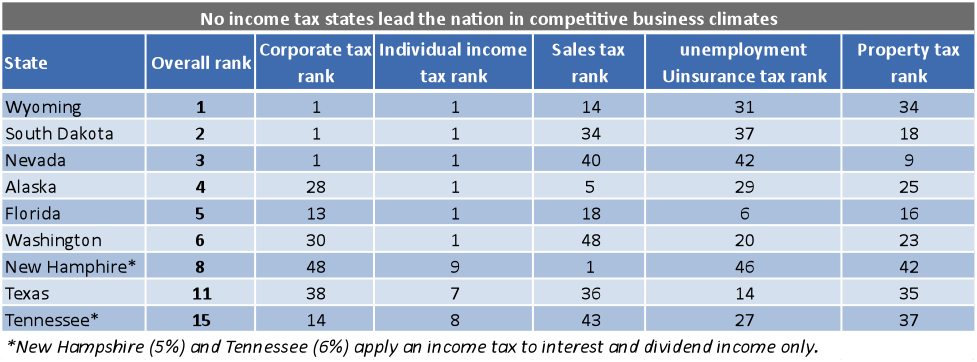

Instead of worsening Illinois’ business climate with a progressive income tax increase, Illinois lawmakers should push to join the nine states without an individual income tax. Some of the nation’s most competitive states are the states that don’t tax income. Between 2001 and 2011, the nine states with no income tax outperformed the nine states with the highest income taxes in population growth, Gross State Product growth, nonfarm payroll employment and state and local tax revenue. Consider the following statistics for this time period:

- Population growth:

- No-tax states: 15 percent

- High-tax states: 6 percent

- Gross State Product growth:

- No-tax states: 63.5 percent

- High-tax states: 45.2 percent

- Nonfarm payroll employment:

- No-tax states: 12.7 percent

- High-tax states: 4.9 percent

- State and local tax revenue:

- No-tax states: 76.3 percent

- High-tax states: 47.9 percent

Opportunity and job creation in Illinois will depend on a more competitive economy. That means learning from the state’s that are getting it right with competitive business climates in today’s modern economy.