6 reasons why Chicago aldermen should oppose Rahm’s property tax hikes

It’s no wonder that more and more Chicago aldermen are balking at Mayor Rahm Emanuel’s property tax hike proposal. They know property tax hikes won’t play well on the campaign trail later this year. Emanuel is calling for $750 million in property tax hikes over five years to prop up just two of the four...

It’s no wonder that more and more Chicago aldermen are balking at Mayor Rahm Emanuel’s property tax hike proposal. They know property tax hikes won’t play well on the campaign trail later this year.

Emanuel is calling for $750 million in property tax hikes over five years to prop up just two of the four city-run pension funds. That’s a far cry from the bolder reforms he championed just two years ago.

His original proposal included increases to government-worker retirement ages, a freeze to cost-of-living adjustments and optional 401(k)-style accounts for new workers. Now, his plan relies mostly on tax hikes and increased contributions from city workers.

There are six reasons why aldermen should oppose Emanuel’s tax-hike proposal:

- Property tax hikes are not popular among voters. Chicago’s aldermen, who face elections in less than 10 months, would have to pass the property tax hike – and that’s not something they want to run on. Chicagoans are already burdened with fees and taxes everywhere they turn, job prospects are poor, and core government services have already seen cuts. Property tax hikes won’t be a winner.

- Emanuel’s proposed tax hike would be just the tip of the property tax increase iceberg. The mayor’s tax hike proposal doesn’t even begin to address the needs of Chicago’s fire and police funds, the city’s worst-funded pensions. Nor does his plan take into account the underfunding of the city’s teacher pension fund, its transit fund or the fund for park district employees. All of them are in bad shape and face the possibility of insolvency if the mayor continues to avoid real pension reform.

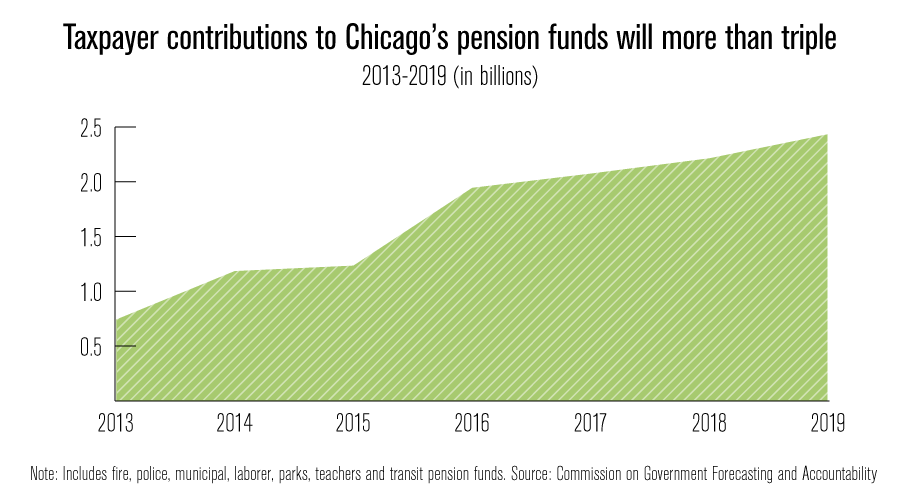

In total, the city’s required contributions to government pensions from 2013-2019 will jump by more than $1.6 billion. That amount dwarfs the $250 million in new tax revenues the mayor’s proposal calls for in 2019.

Emanuel hasn’t yet said where the remainder – nearly $1.4 billion a year – will come from. If he uses the same blueprint he’s proposing today, one can only assume more taxes.

Aldermen are right to be skeptical of Emanuel’s tax-hike plans.

- None of Emanuel’s property tax hikes will be used to put more policemen on the street. None will go to improve Chicago’s classrooms. And none will go to health care for the city’s poor. Instead, every single penny will go to pensions. And even that won’t be enough.

- Throwing more money at pensions does nothing to fix the problem of ever-increasing retirement costs. Pensions are squeezing out everything else in Chicago’s budget because government workers can retire in their 50s, they are living longer and their benefits outstrip those of the private sector.

No matter one’s views on public pensions, these benefits are no longer sustainable within the city’s crumbling budget. Nor are they affordable for the average city resident who bears the higher costs through more taxes and cuts to core government services.

Chicago residents are already on the hook for $63.2 billion in government pensions and other long-term debt. This staggering figure totals more than $23,000 per Chicago resident, or more than $61,000 per household.

Pension costs won’t stop rising uncontrollably until the current system is modernized.

- Emanuel’s plan doesn’t make city-worker retirements more secure. The police officers’ fund has just 31 cents for every dollar required to pay out future benefits. The firefighter fund, just 25 cents. These pension funds are effectively bankrupt and Emanuel’s plan does nothing to make city worker retirements more secure.

Emanuel avoids the real reforms that include hybrid and self-managed plans. That means city workers must stay trapped in a collapsing system with no voice, no control and no exit.

And that’s not all. In addition to making city workers pay higher property taxes, Emanuel is also forcing them to increase their pension contributions by nearly 30 percent by 2019.

- Businesses and people hate property taxes. Chicago needs to stem the number of people and businesses leaving the city, not increase it. Chicagoans have been fleeing for the suburbs and collar counties for more than two decades.

Since 1992, Cook County has lost more than 800,000 people on net; many to its neighboring counties including Lake County, Ind.

Higher property taxes, and the threat of more to come, will only make things worse.

Emanuel has responded to those critical of his plan by calling for others to put forward alternatives that are “sustainable and consistent.” His plan is neither.

But the Illinois Policy Institute recently delivered a proposal to the mayor that is both.

It’s a plan aldermen can run on. It creates real retirement security for city workers by giving them control over their own retirements and protects taxpayers by not resorting to property tax hikes. Most importantly, the plan fully protects the already-earned benefits of city workers and retirees.

And it’s the only proposal that cuts the city’s pension debt in half immediately, granting desperately needed relief to the city’s budget.

At its core, the proposal is a hybrid pension plan that gives workers the ability to participate in market returns through a self-managed account, and also protects them by providing guaranteed income in the form of a Social Security-like benefit.

The proposal also means-tests cost-of-living adjustments to guarantee annual increases for workers who dedicated their careers to the city but receive small pensions.

Chicago’s aldermen need to send the mayor a strong message: A tax hike isn’t reform. Giving city workers more voice, more control and more options is.