3 reasons why Chicagoans can’t afford the latest CTU contract

A career teacher can expect to collect $2 million in benefits during his or her retirement.

Over the past few years it’s become harder and harder for ordinary Chicagoans to make ends meet. The lack of jobs, growing crime, and the stifling and costly city bureaucracy are taking an increasing toll on residents.

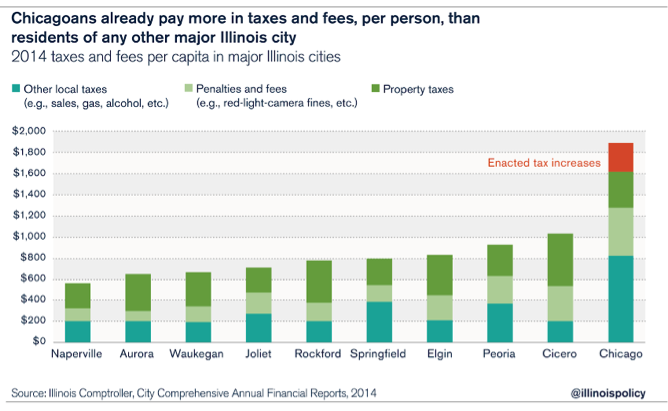

With so many other burdens piled on top of them, the last thing Chicagoans can afford is more taxes. Chicagoans already pay the highest per capita local taxes and fees in the state – nearly double what residents in the next highest-taxing city pay. Unfortunately, that’s exactly what they’ll be hit with considering the outcome of the city’s negotiations with the Chicago Teachers’ Union.

The CTU and Chicago Public Schools officials announced Oct. 11 that both sides have agreed to a new teacher’s contract that spends more money and caves on CPS’ most desired reform. Mayor Rahm Emanuel, unwilling to risk what remains of his political career, has apparently sold out Chicago taxpayers once again.

Under the terms of the new 4-year contract, teachers will receive raises of 2 and 2.5 percent in 2018 and 2019 on top of “step and lane” salary bumps – which are automatic salary increases for length of tenure and the educational attainment of teachers granted regardless if they improve educational outcomes or not.

In addition, CPS agreed to continue “picking up” the employee pension contribution for current CPS teachers – a benefit that costs the school district, meaning taxpayers, more than $130 million every year. Since 1981, CPS has paid 7 of the required 9 percent annual employee contribution as a perk for teachers, meaning teachers only contribute 2 percent of their annual salaries toward their own pensions.

Under the contract, newly-hired teachers won’t receive the pickup benefit. However, CPS agreed to grant new teachers additional 3.5 percent raises in exchange.

The failure to reform pick-ups for existing teachers is disappointing, as the elimination of the pension pickup for all teachers was the bedrock of CPS’ negotiations. The district went so far as to include the elimination of pension pickups as a part of its official budget earlier this year.

The bottom line is this new contract piles hundreds of millions of additional costs onto an already junk-rated, insolvent school system. The only way CPS is likely to pay for this is through more borrowing, more deficits, and more taxes on Chicagoans.

The last time the mayor gave in to CTU demands was in October 2012, when the district was facing a $1 billion budget deficit and an $8 billion teacher pension shortfall. Emanuel’s ill-fated agreement with the then-striking union cost CPS, hundreds of millions of dollars, if not billions, in higher operating and retirement costs. Those higher costs eventually led to thousands of teacher pink slips, 50 school closures, the need for safe passage routes through gang areas and the district’s spiral toward insolvency.

This latest contract will create as just as many negative consequences for Chicago’s taxpayers, parents and students, and even teachers themselves.

Here’s why Rahm shouldn’t have caved to the CTU’s demands:

- Chicago taxpayers are already overburdened.

This latest contract will likely cost CPS hundreds of millions of dollars that they’ll pass on to Chicagoans through additional taxes.

The problem is, city residents and businesses are already overburdened with an oppressive amount of taxes and fees.

Chicagoans already pay more in taxes and fees – including property taxes – than residents in any other major Illinois city. Chicagoans pay almost double what residents in Cicero – the next most taxing-city – pay.

Residents were already hit last year with a record property tax increase that came with additional hikes, from garbage collection fees to ridesharing taxes. Combined with the property tax hike, those increases will cost Chicagoans over $700 million a year when fully phased in by 2018.

If that weren’t enough, the city passed a new $240 million utility tax hike this year to pay for laborer and municipal worker pensions. And further taxes on Chicagoans are incoming. CPS’ budget includes a $250 million property tax increase it wants the city to pass.

Another set of tax hikes to pay for this latest contract will only serve to punish Chicagoans further and drive many to seek out opportunities elsewhere – as a record number of residents are already doing.

- Ordinary Chicagoans already struggle to pay for teachers’ top-ranked salaries.

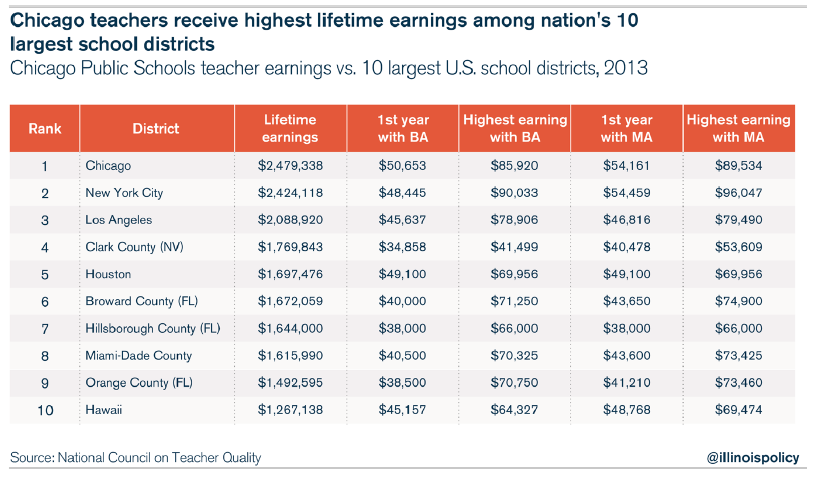

CPS agreed to the CTU’s demand for salary increases despite the fact that, according to a 2014 report from the National Council on Teacher Quality, Chicago teachers already earn the highest lifetime earnings compared with teachers in the 10 largest school districts in the nation.

Private-sector Chicago workers, who make a median salary of $32,000, will be forced to pay additional taxes to provide raises to CPS teachers, who make an average of nearly $73,000 a year.

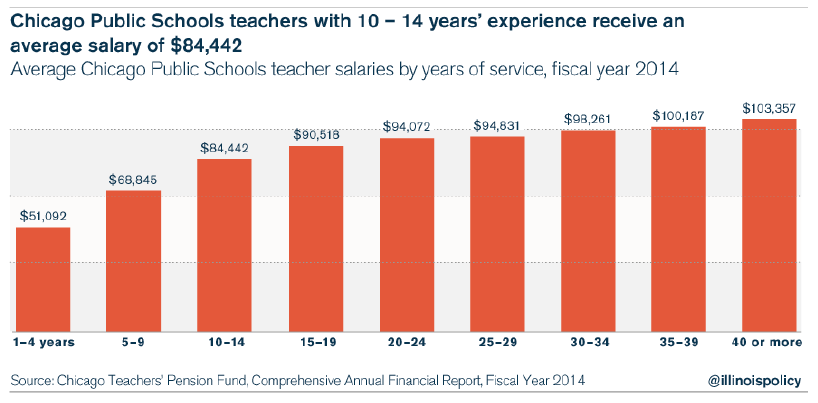

In addtion, CPS’ salary schedule is designed to rapidly increase salaries during the first decade of service. With 10 to 14 years of service, a Chicago teacher’s average salary equals more than $84,000 a year.

And those high salaries will end up costing Chicagoans twice – first in large payroll costs, then again in higher pension costs.

- Chicago taxpayers already pay for millionaire teacher retirements.

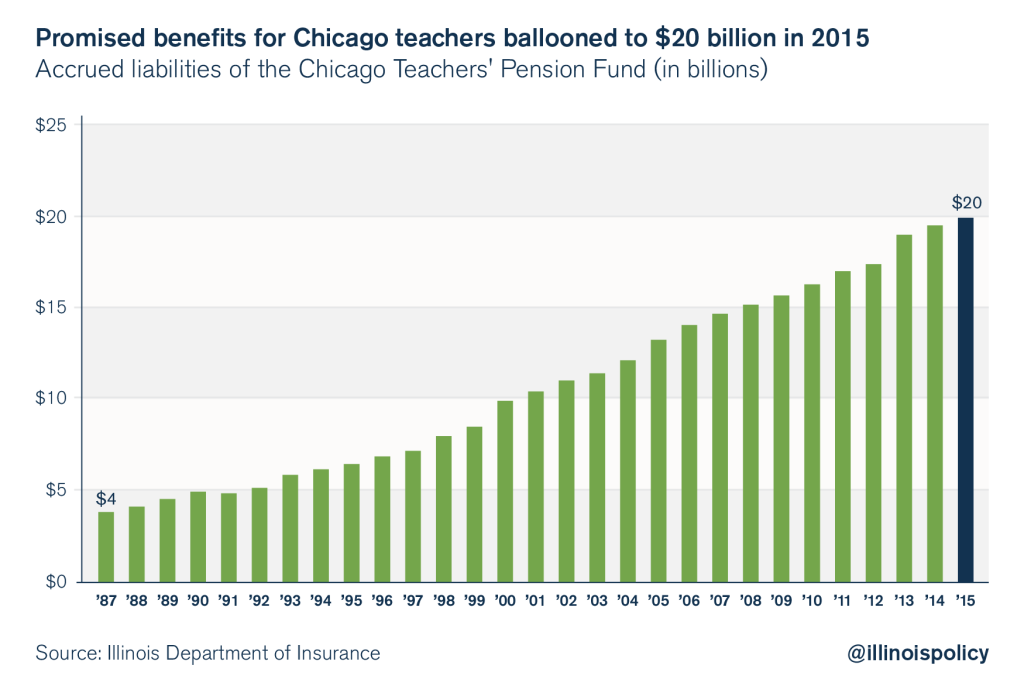

The high salaries CPS pays its teachers translate directly into generous pension benefits. The average pension for a recently retired career (30 years or more) Chicago teacher is now $72,000. A career teacher can expect to collect $2 million in benefits during his or her retirement.

In all, the pension benefits promised to Chicago teachers have grown by 400 percent since 1987. That’s an annual rate of 6.1 percent a year, more than twice the rate of inflation and far faster than the growth than CPS’ revenues or Chicagoans’ incomes.

The Chicago teachers’ pension shortfall has risen 20 percent since 2012, to over $9.5 billion in 2015. At the same time, CPS’ required contributions to teachers’ pensions have skyrocketed by more than $500 million. Those pension payments are crippling CPS, forcing the school system to borrow money to make its payments and fund daily operations.

Just another bad deal

CPS is in a financial crisis. The district has an unbalanced budget, soaring borrowing costs, a record amount of debt, and a junk credit rating. It simply can’t afford any salary or pension increases.

This latest contract is a further sign to struggling Chicagoans that city and school district officials are completely unwilling to make the hard choices necessary to enact real reform. Instead, they’ll continue to hit overburdened taxpayers in order to bail out the city, CPS and government worker pension funds.

Rahm may think he has averted his next big crisis. But instead, all he’s done is give Chicagoans even more reason to leave.