3 drivers causing police and firefighter pension costs to skyrocket in Elgin

Diverting taxpayer dollars from pensions to salaries, underfunding pensions, and providing unsustainably high pension benefits have caused Elgin, Illinois’ combined police and firefighter pension shortfalls to double in just nine years to $180 million.

Each year, Illinois property owners struggle to understand why their property taxes are swallowing more and more of their take-home pay.

Illinois has more than 650 local-government pension plans, largely for police and firefighters, and most are effectively bankrupt. Today, half of the largest cities in Illinois have police and firefighter pension funds with just half the funds needed today to pay out future pension benefits.

As a result, taxpayer contributions toward government-worker pensions are rising dramatically in cities across the state. Just look at Elgin.

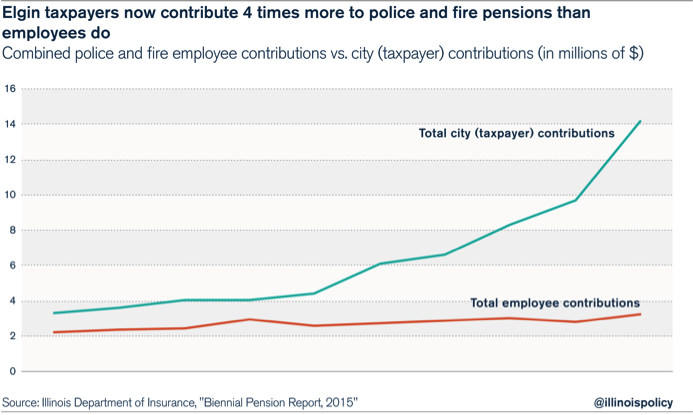

In 2005, Elgin taxpayers were putting in $1.50 for every $1 that police and fire department employees contributed toward their own pensions. Today, taxpayers are putting in nearly $4.50 for every $1 dollar those employees contribute.

Why is this the case for Elgin and so many other municipalities across Illinois?

1. For years, local government officials have diverted taxpayer funds that should have gone toward government-worker pensions and used them instead to boost government- worker salaries.

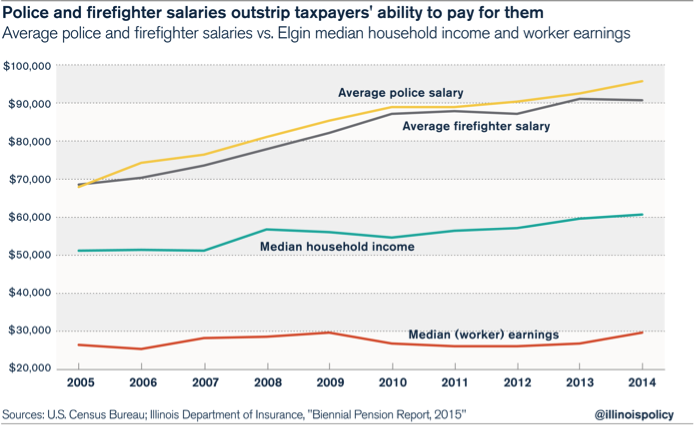

Police and fire department employees have seen their salaries rise nearly 1.5 times faster than inflation since 2005. During that same time, Elgin residents’ incomes haven’t kept up with inflation.

The average salaries of police and firefighters in Elgin now exceed $90,000, far above the $60,000 average Elgin household income and nearly triple the median earnings of an Elgin worker.

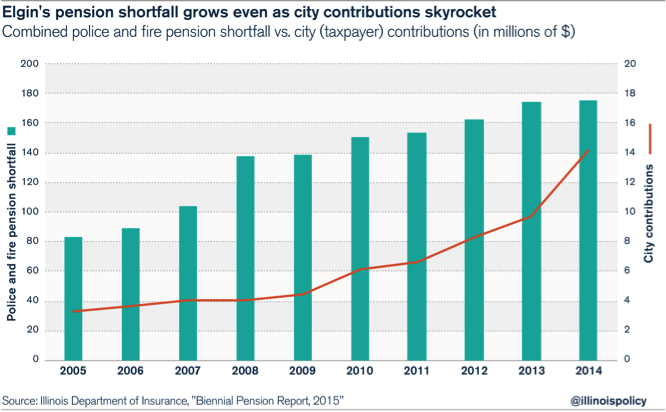

2. By not properly contributing toward police and firefighter pensions, Elgin allowed the funding shortfalls for these pensions to grow. Underfunding contributed significantly to a doubling in Elgin’s combined firefighter and police pension shortfall in just nine years – to nearly $180 million.

That shortfall is a debt that city and state leaders expect taxpayers to pay. Because government workers cannot be asked to increase their own pension contributions, the shortfall lands squarely on the backs of taxpayers.

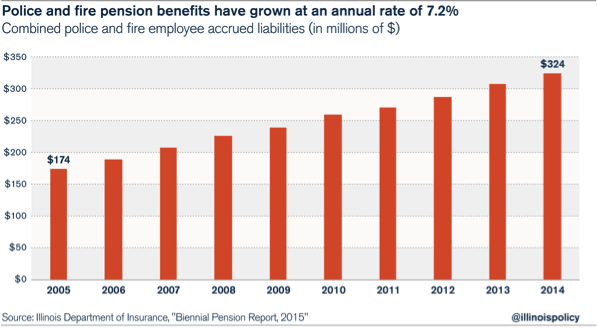

3. Inflated salaries made the pension-funding shortfall grow. Since future pension benefits are based on a government worker’s final salary, the higher salaries go, the more benefits workers accrue.

Those raises helped propel Elgin’s accrued pension benefits at an unsustainable pace – an average of 7.2 percent each year since 2005. That’s more than three times the pace of inflation. Accrued benefits for current and future retirees nearly doubled to $324 million in just nine years – far more than the city can afford.

Police and firefighter pensions are demanding more and more from cities and their taxpayers at a time when it’s harder than ever for municipalities and residents to make increased contributions. Elgin is typical of what’s happening across the state.

The only way to solve these cities’ fiscal crises is to end the broken defined-benefit pension plan altogether. That starts with moving new workers into 401(k)-style retirement plans and offering current workers the option to participate in 401(k)-style plans of their own.

And if the General Assembly won’t initiate 401(k)-style reform plans, then local governments should have more control over how they operate, including being allowed to file bankruptcy, if necessary.