2 graphics show why Illinois’ social services and taxpayers are getting stiffed

Government worker retirement costs and interest on state retirement debt are squeezing out funding for social service providers and taxpayer relief.

In Illinois the spending rule is simple: Government unions get paid first.

Social service providers that need funding have to wait in line. Taxpayers who need relief have to move to another state.

Social service providers are facing extraordinary payment delays due to Illinois’ budget impasse. This puts providers and their dependents under tremendous stress. A survey conducted by United Way showed that nearly 1 million Illinoisans reliant on social services have been affected by the state’s budget impasse.

Another survey from the Paul Simon Public Policy Institute showed that strong majorities of working age adults want to leave Illinois, and taxes are the No. 1 reason why.

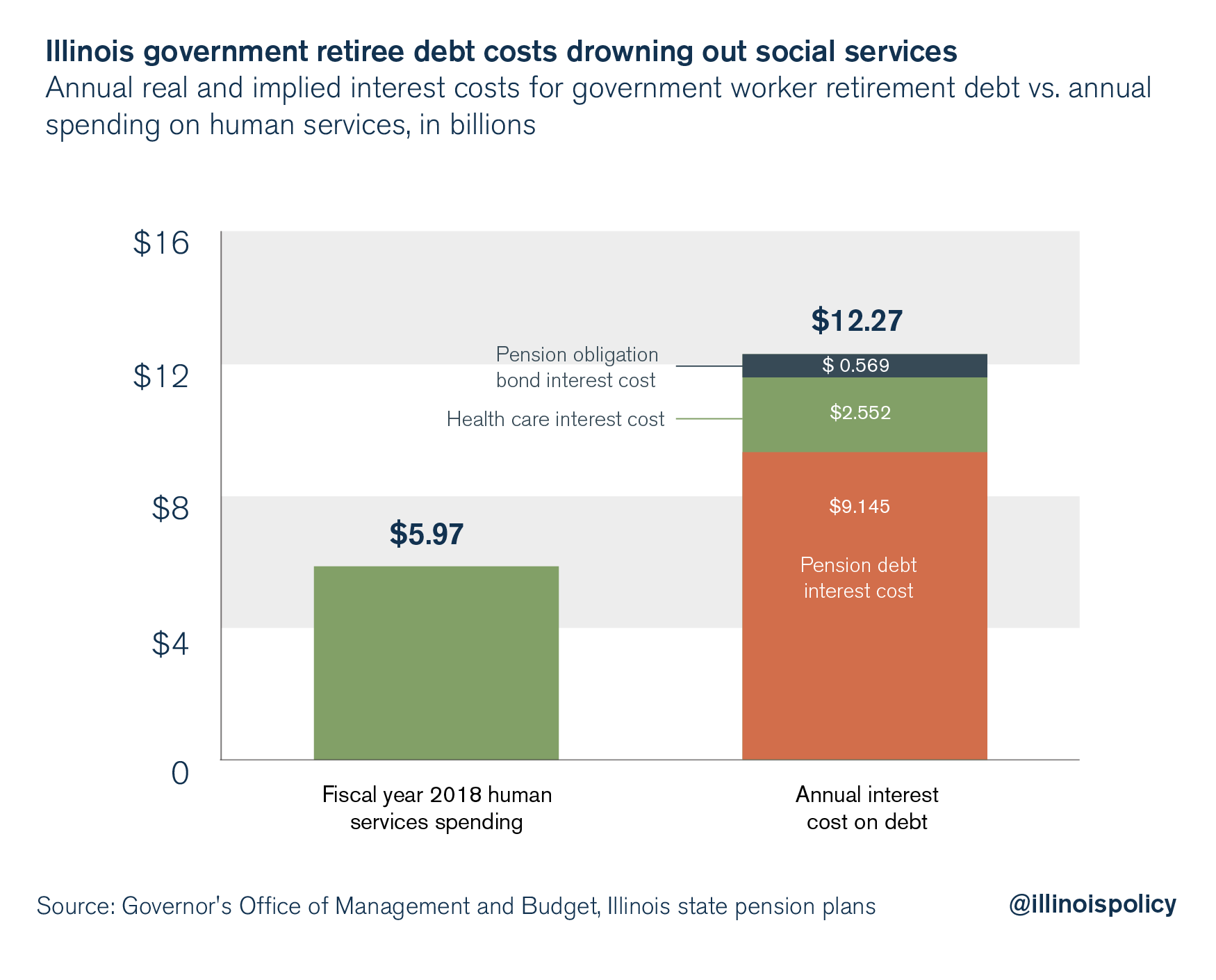

The underlying financial problem is that Illinois has a black hole of debt consuming billions of tax dollars each year – and it continues to grow. The annual interest for state government worker retirement plan debts alone costs over $12 billion, squeezing out spending on social services and tax relief for residents.

So why do social service providers and taxpayers continue to suffer in Illinois?

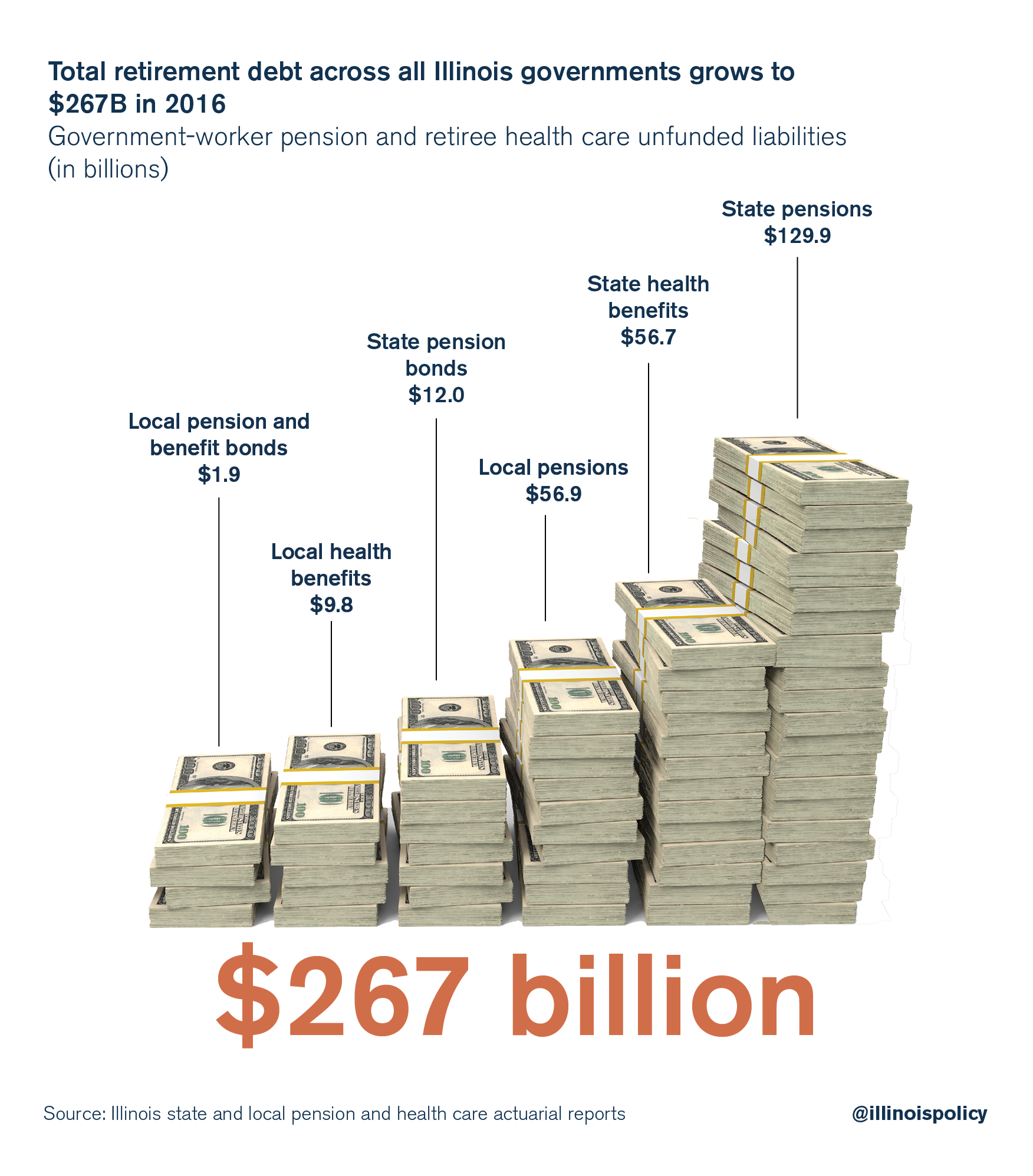

- Illinoisans are on the hook for $267 billion in state and local government retirement debt. The state government is on the hook for $198.6 billion of that debt while local governments carry $68.6 billion.

- No money left for social services and tax relief. Illinois’ unfunded debts come with substantial interest costs. Illinois social services are being drowned out by debt service. Between the mountains of debt and the interest cost on the debts, there’s no money left for social services or tax relief. For example, the interest cost on debt for government worker retirement plans is more than $12 billion per year. By comparison, Gov. Bruce Rauner’s budgeted amount for human services, which includes social service grants, is just under $6 billion per year. The total interest cost on the debt for government worker retirement plans is more than twice what is budgeted for human services.

Instead of social services and tax relief, the General Assembly prioritizes the pay and perks of government unions. In fact, having social service providers and dependents openly suffer creates more public sympathy for a tax hike. This is exactly what leaders like House Speaker Mike Madigan and Senate President John Cullerton want. Without another tax hike they would be forced to solve Illinois’ spending problems. The real problem – Illinois’ extraordinary debts – continues to fester.

So why does Illinois keep raising taxes and throwing good money after bad? Well, according to Cullerton, because that’s what the unions want lawmakers to do.

At Elmhurst College’s annual government forum, Cullerton told his audience that the biggest reason lawmakers haven’t reformed public pensions was because unions don’t want them to. “The teachers and state employees are not in favor of it. … That’s why it’s very difficult to pass,” said Cullerton in a statement reported by the Illinois News Network.

Following Cullerton’s logic, Democratic legislators allow Illinois to be consumed by debt because that’s what the government unions want. They also continue to tax families out of the state because government unions want more benefits. And Democratic legislators allow social services to wither on the vine because government unions get paid first.

State politicians should do their job and set spending priorities – that’s what budgeting is. And if there’s not enough money to go around then they need to decide what gets cut. Taxpayers and those dependent on social services should be protected, and the constitution should be amended so that lawmakers can cut massive debts.