Illinois school districts seeking 14 countywide sales tax hikes in November

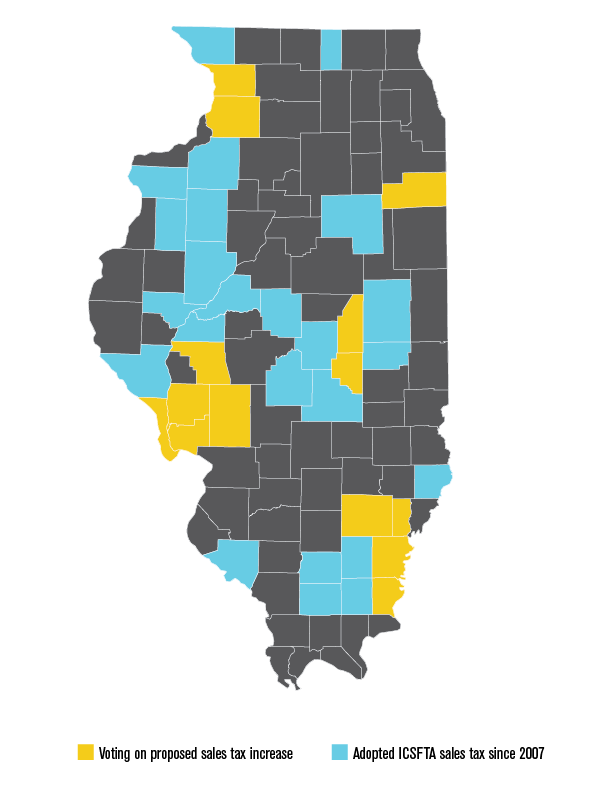

School districts in 14 Illinois counties are pushing for countywide increases in sales tax rates. These counties are utilizing the 2007 Illinois County School Facility Tax Act, or ICSFTA, which allows school boards representing 51 percent of a county’s population to put a referendum on the ballot for a countywide sales tax increase to fund...

School districts in 14 Illinois counties are pushing for countywide increases in sales tax rates.

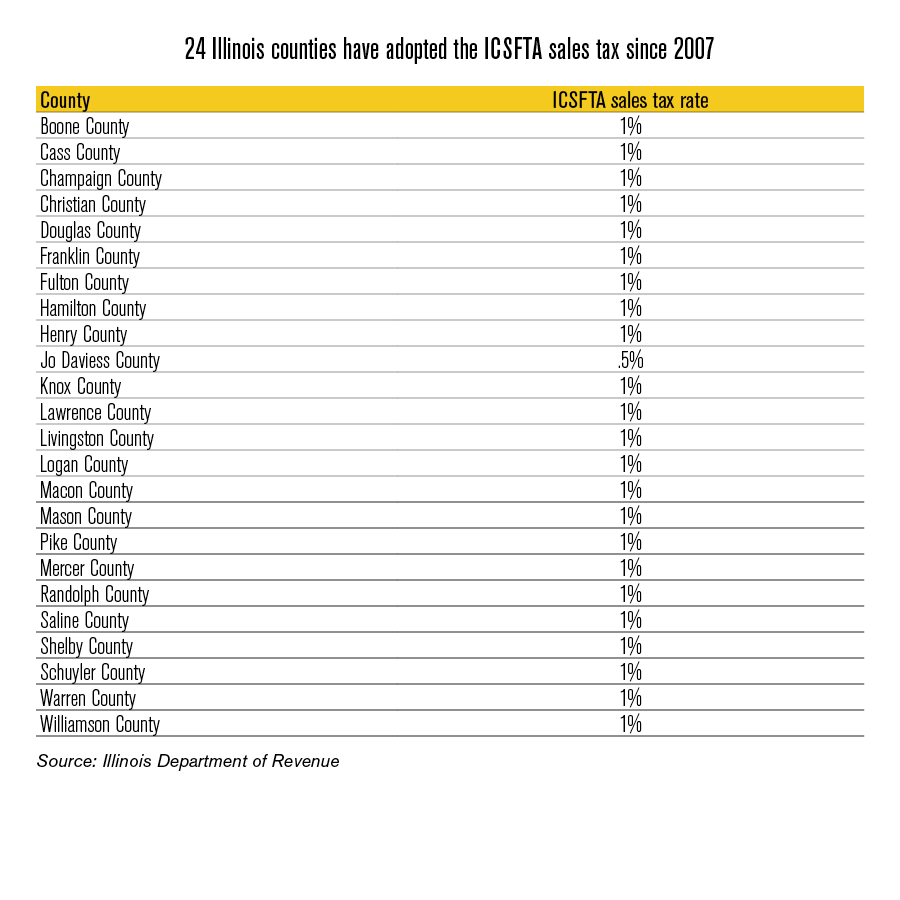

These counties are utilizing the 2007 Illinois County School Facility Tax Act, or ICSFTA, which allows school boards representing 51 percent of a county’s population to put a referendum on the ballot for a countywide sales tax increase to fund school facility improvements.

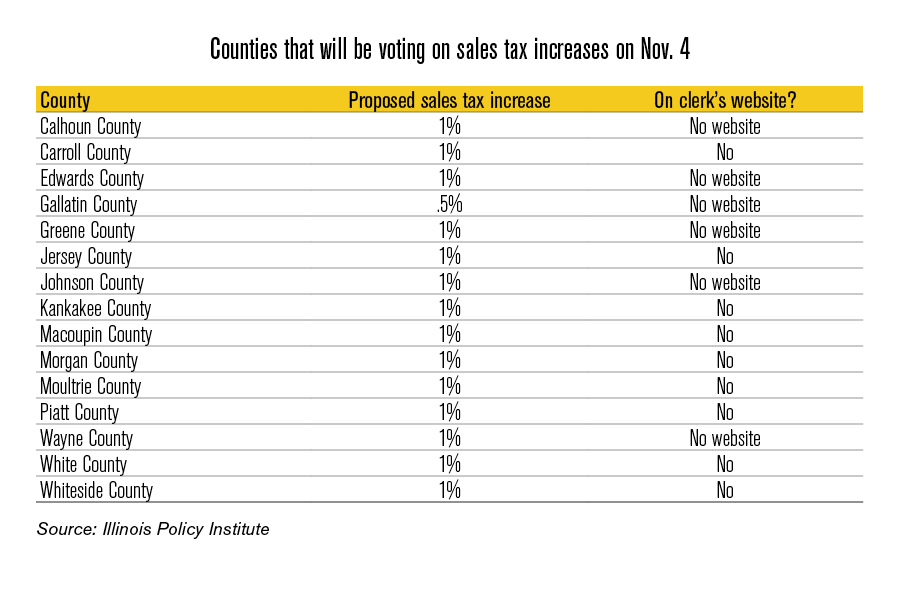

Unfortunately, many voters are left in the dark and may not even know these referendums will be on their ballots in November. Those who want to be informed won’t find the information on the State Board of Elections website.

Taxpayers aren’t likely to find information on county websites either. County clerks are responsible for managing the election process in each county, but none of the 14 counties had any information about the tax increase referendums on their websites.

Below is a list of the counties that will be voting on sales tax increases on Nov. 4.

Calhoun County, Carroll County, Edwards County, Gallatin County, Greene County, Jersey County, Kankakee County, Macoupin County, Morgan County, Moultrie County, Piatt County, Wayne County, White County, Whiteside County.