The myth of an Illinois comeback

Illinois is dead last of all 50 states in recovering from the Great Recession – and two economic surveys prepared each month by the Illinois Department of Employment Security, or IDES, and the U.S. Bureau of Labor Statistics prove it. The BLS and IDES surveys track employment and jobs growth in Illinois: both household surveys...

Illinois is dead last of all 50 states in recovering from the Great Recession – and two economic surveys prepared each month by the Illinois Department of Employment Security, or IDES, and the U.S. Bureau of Labor Statistics prove it.

The BLS and IDES surveys track employment and jobs growth in Illinois: both household surveys track Illinois’ headline unemployment rate along with the state’s overall employment growth, and both business surveys show the number of net new payroll jobs each month.

Both surveys point to one objective reality over a fair time frame.

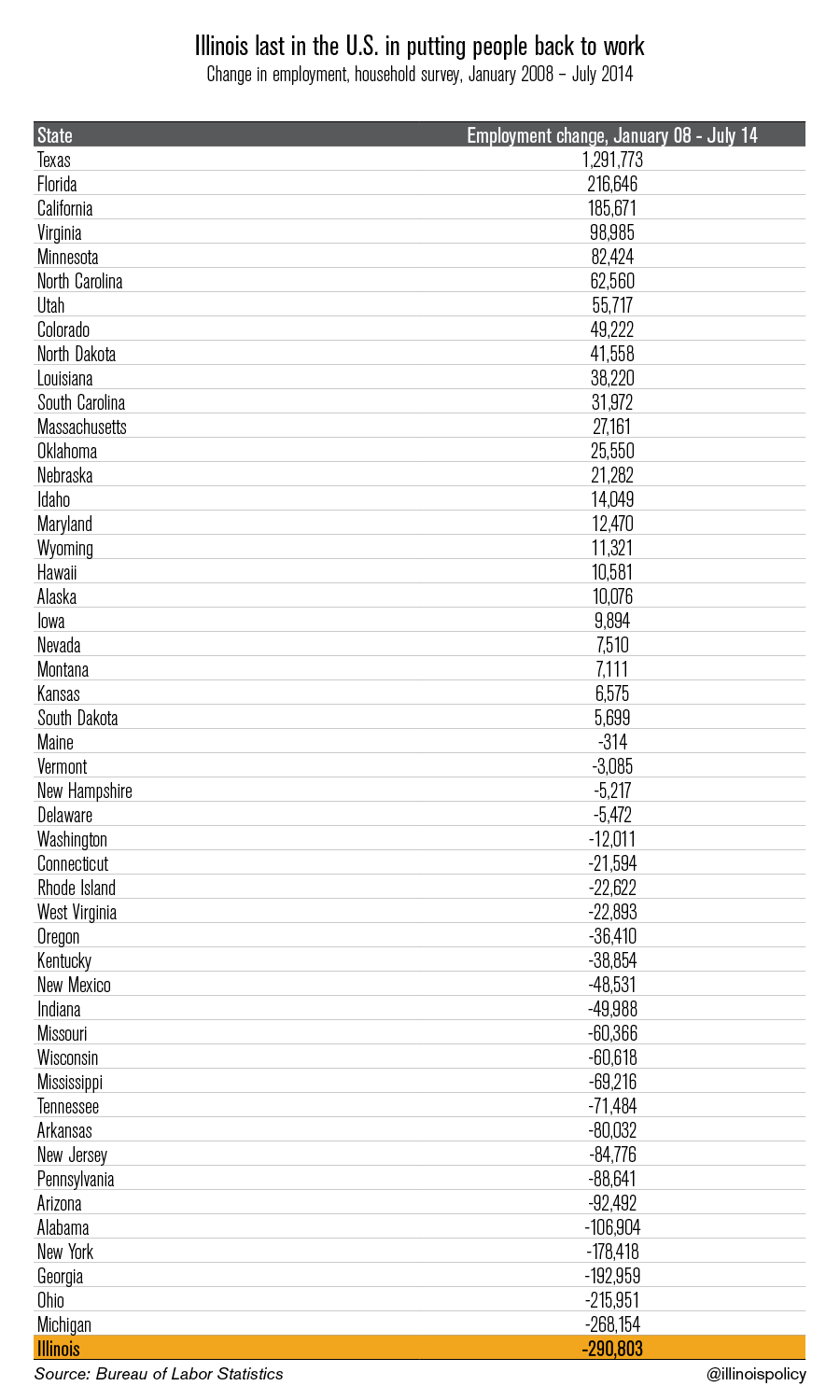

The household survey shows that since January 2008, when employment losses from the recession began, there are 290,000 fewer people employed in Illinois. This puts Illinois 50th out of 50 states for recovering employment losses.

Twenty-four out of 50 states have recovered all employment losses from the Great Recession. Texas leads all states, with 1.3 million more people working today than before the recession began.

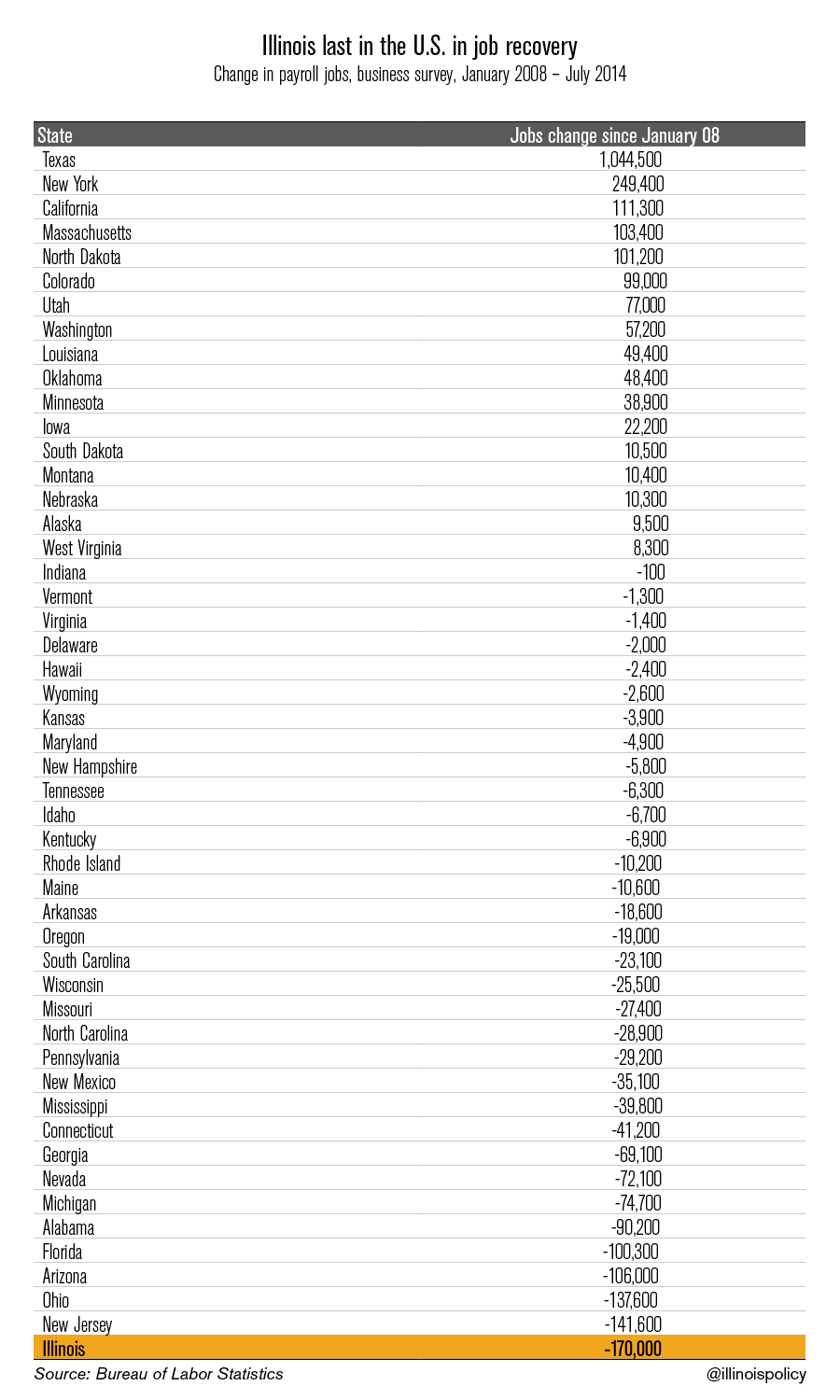

Illinois also ranks 50th out of 50 states on the business survey. According to the business survey, Illinois is still down 170,000 payroll jobs since the recession began.

Texas, once again, claims the lion’s share of the comeback, having created over 1 million net new payroll jobs since the recession began.

A number of factors have contributed to the worst recovery in the U.S.

Policy leaders have done nothing to reform Illinois’ broken system of cronyism and excessive business regulation. The state’s nonsensical regulations and excessive wait times contribute to a dismal business environment, which was given an F by local small businesses.

However, the most blatant policy misstep was the historic 2011 income tax hike, which raised taxes on all Illinoisans by 67 percent, and signaled to business the state’s determination to follow a tax-and-spend direction. The 2011 income tax hike put the brakes on Illinois’ jobs recovery, dramatically slowing down a recovery that, up until that point, had been keeping pace with the rest of the Midwest and U.S.

Employment growth, reflected on the household survey, has slowed down by more than one-half since the tax hike. Employment growth has accelerated for the rest of the U.S. since the same date.

Jobs growth, reflected on the business survey, has slowed down by one-third since the 2011 tax hike. Jobs growth has accelerated for the rest of the U.S. since the same date.

The first steps necessary for beginning a real recovery include admitting that there is a problem and addressing the symptoms.

One obvious cause is the 2011 income tax hike. To allow the state to heal, lawmakers must allow it to sunset.