Tax Foundation: Progressive income tax would destroy Illinois’ businesses climate

The Tax Foundation released an analysis of the proposal to dump Illinois’ fair, flat tax in favor of a progressive tax that would force people to pay higher taxes as their income increases. The conclusion was unsurprising: a progressive income tax would deliver a devastating blow to Illinois’ already struggling business climate. The Tax Foundation...

The Tax Foundation released an analysis of the proposal to dump Illinois’ fair, flat tax in favor of a progressive tax that would force people to pay higher taxes as their income increases. The conclusion was unsurprising: a progressive income tax would deliver a devastating blow to Illinois’ already struggling business climate.

The Tax Foundation ranks states based more than 100 different variables that fit into five broad categories: major business taxes, individual income tax, sales tax, unemployment insurance and property tax. The index ranks the general competitiveness of state tax systems – with 1st being the most competitive and 50th being the least competitive state tax system. A state with a ranking of No. 1 is considered the most competitive economically.

Illinois had the 17th most competitive tax climate for businesses just a few years ago. But the state’s rank plummeted 14 spots in the Tax Foundation’s “State Business Climate Index,” to 31st from 17th, after Illinois lawmakers passed a record tax increase on individuals and businesses in 2011.

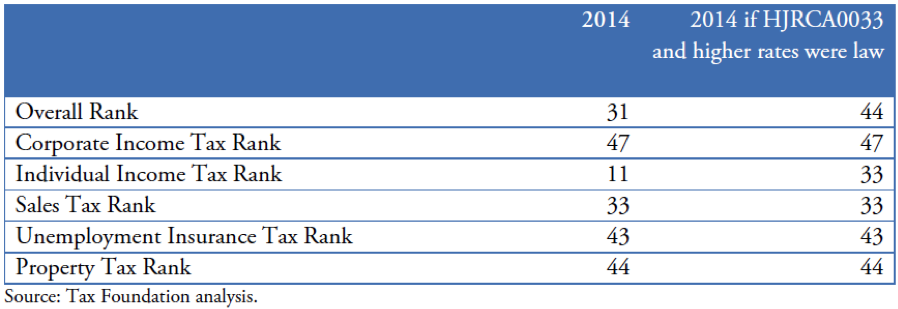

Illinois’ ranking would take a second tumble if lawmakers pass a progressive income tax plan that has been proposed. According to the report, a progressive income tax would drop Illinois’ business tax climate ranking down to 44th:

Looking exclusively at changes to income tax rates, had HJRCA0033 and the proposed rates been in place on July 1, 2013, the snapshot date for our 2014 State Business Tax Climate Index, Illinois would have ranked 44th best for business tax climate, rather than 31st (see Table 3). If corporate rates were made higher and more progressive as well, a change we do not consider here, Illinois’ Index score would worsen further.

The Tax Foundation scored the progressive tax plan proposed by state Rep. Naomi Jakobsson, D-Champaign. Under current Illinois law, the individual income tax rate will be 3.75 percent in 2015. Under Jakobsson’s new plan, however, a higher 4 percent rate kicks in for people earning more than $18,000. That income tax rate targets Illinois’ working class.

Source: Illinois Policy Institute analysis

Jakobsson’s progressive tax rates specifically attack the middle class as well. Her 5 percent tax rate applies to people earning more than $36,000. When an Illinoisan begins earning more than $58,000, Jakobsson’s tax rates jump to 6 percent, and again to 7 percent on income earned after $95,000 – nearly double the rate Illinoisans will pay in 2015.

It’s no surprise a progressive income tax would destroy Illinois’ business tax climate. Most recently, between 2001 and 2011, the nine states with no income tax outperformed the nine states with the highest income taxes across many important economic indicators. Consider the following statistics for this time period:

Population growth:

- No-tax states: 15 percent

- High-tax states: 6 percent

Gross State Product growth:

- No-tax states: 63.5 percent

- High-tax states: 45.2 percent

Nonfarm payroll employment:

- No-tax states: 12.7 percent

- High-tax states: 4.9 percent

State and local tax revenue:

- No-tax states: 76.3 percent

- High-tax states: 47.9 percent

The best way forward for Illinois is a competitive business climate that attracts jobs creators and investment. The Tax Foundations’ recent analysis shows that a progressive income tax would ruin any potential to make that happen.