Six places Chicagoans will flee to if property tax increases are part of Chicago’s pension fix

There’s one simple reason why Detroit finally filed for bankruptcy in 2013. When it came time to pay its bills, the Motor City had run out of taxpayers. Taxpayers fled Detroit for decades as the city’s tax bill kept growing and its vital government services, such as public safety, were slashed. Detroit has lost more...

There’s one simple reason why Detroit finally filed for bankruptcy in 2013. When it came time to pay its bills, the Motor City had run out of taxpayers.

Taxpayers fled Detroit for decades as the city’s tax bill kept growing and its vital government services, such as public safety, were slashed.

Detroit has lost more than 1 million people from its peak population of nearly 2 million in the 1950s.

You can’t blame them for leaving. Families weren’t getting their money’s worth and they believed, rightly, that conditions would only worsen.

That’s just the predicament Chicagoans face today. Each household owes more than $61,000 in future taxes to pay down the massive long-term debt – more than $63 billion in bonds and pension shortfalls – that their city and county governments have racked up.

Morningstar recently reported that Chicago had the highest per capita pension liabilities among the nation’s largest 25 cities, including Puerto Rico. And as a harbinger of more bad news for Chicago, the commonwealth’s debt was recently downgraded by the major credit agencies to junk-bond status.

Chicago’s debt already received a rare triple-notch downgrade last year from Moody’s Investor Services. It is now just four notches away from becoming junk.

With a more than $1 billion operating shortfall expected at the city of Chicago and the Chicago Public Schools in the next couple of years, both will continue to cut services and increase fees to make ends meet. CPS already shuttered more than 50 schools, but even that move did little to improve its finances.

In the absence of real pension and spending reforms that avoid tax hikes, Chicagoans will need to prepare for higher property taxes, higher fees and more service cuts.

Unless they, too, choose to leave.

People with means have already been moving over the Cook County border for more than 20 years. They continue to access the amenities of Chicago, but avoid the many high costs of living in it.

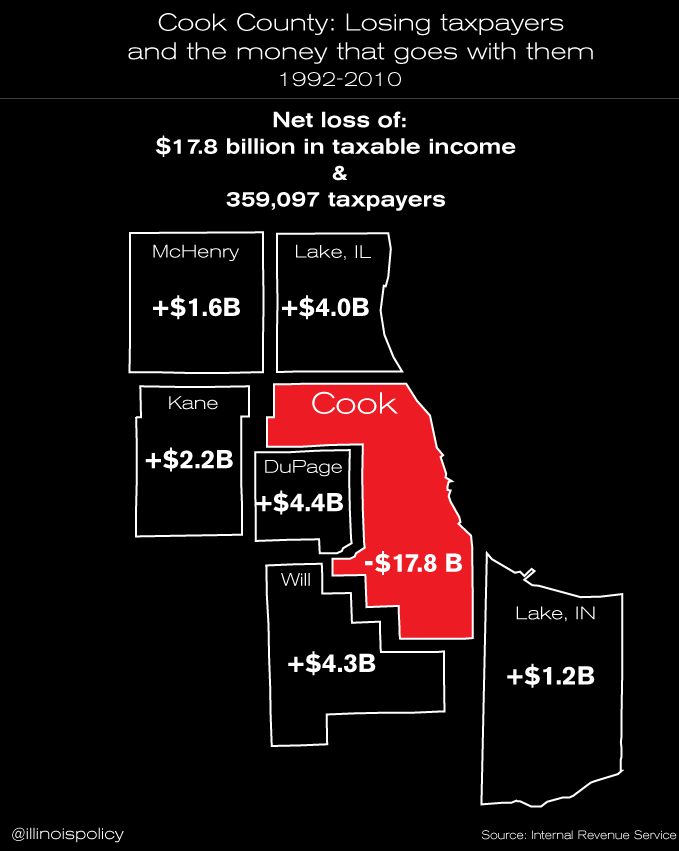

According to Internal Revenue Service data, from 1992 to 2010 here are the top six places Cook County has lost out to – and the taxable income it’s forgone:

- DuPage County won a net 71,289 taxpayers from Cook County. Those taxpayers took more than $4.4 billion in taxable income with them.

- Will County won a net of 71,148 taxpayers from Cook County. Those taxpayers took $4.3 billion in taxable income with them.

- Lake County, Ill., won a net of 47,844 taxpayers from Cook County. Those taxpayers took $4 billion in taxable income with them.

- Kane County won a net of 32,772 taxpayers from Cook County. Those taxpayers took $2.2 billion in taxable income with them.

- McHenry County won a net of 25,713 taxpayers from Cook County. Those taxpayers took $1.6 billion in taxable income with them.

- Lake County, Ind., won a net of 27,549 taxpayers from Cook County. Those taxpayers took $1.2 billion in taxable income with them.

In all, Cook County lost a net of 276,000 taxpayers to its six nearby counties from 1992 through 2010. And when their dependents are included, Cook County lost a net of nearly 750,000 people.

Painfully, those taxpayers took nearly $18 billion in taxable income with them from 1992 to 2010.

Chicago’s population has already dropped below its 1920 levels. The city is bleeding taxpayers and it can’t afford to lose more. If it does, it will create a death spiral of fewer and fewer taxpayers holding an ever-growing bill.

We know how that story ends.