Illinois’ collapsing state pension systems are seen as the poster child of pension crises across the nation. But another pension crisis is taking place even closer to home.

There are nearly 650 locally run pension funds in Illinois, which cover retired police officers and firefighters, along with one consolidated fund for municipal retirees, called the Illinois Municipal Retirement Fund, or IMRF.

Many of these local pension funds are nearing insolvency.

Illinois’ municipal pension systems are destroying city budgets, pushing property taxes higher and forcing cuts in local services.

Pension costs are consuming more of quickly growing property tax bills. The city of Springfield, for example, now dedicates 100 percent of its city property taxes to pay for the pensions of police, fire and city workers.

And even that’s not enough. The city’s annual pension costs now exceed its total general fund property tax revenue. This has forced the city to cut funding sources for other core services – Springfield has been forced to cut its police force by nearly 15 percent since 2007.

Other cities have raised taxes and fees to combat rising pension costs. Peoria has added new water and natural gas utility taxes, and also doubled its garbage collection fees to help fund its growing pension commitments. Despite this, the city’s pensions are still critically underfunded.

Pensions are wreaking havoc on city budgets even though Illinois already has the second-highest property tax burden in the nation.

Without real pension and spending reforms, cities will plug their fiscal shortfalls with even higher property taxes.

Local pension audit

The Illinois Policy Institute audited 114 of the state’s largest cities to expose the impact of local pensions on taxpayers, property taxes and city budgets.

The audit scored all 114 cities on 10 metrics based on a 100-point scale, with 100 being the best score.

The 100-point scale is broken into a five-part grading scale – 90 and above being a passing grade, and 59 and below indicating a critical situation.

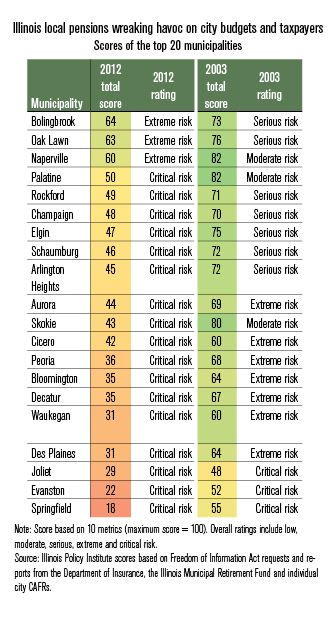

The scores of the top 20 cities in Illinois have collapsed over the past 10 years.

In 2003, only three cities were in critical condition.

Today, 17 cities have a critical rating.

The same decline in scores happened across the entire state.

The same decline in scores happened across the entire state.

Just 10 years ago, 31 of the 114 cities received a score of 80 or above. Today, only a single city does, with nearly 80 percent of all cities now in critical condition.

Additional key findings from this report include:

• Local pension costs in many cities have grown beyond the ability of property taxes to pay for them. Pension costs consume 100 percent of property taxes in 10 of the audited cities.

• In Illinois’ 20 largest cities, taxpayer contributions to pensions, in the form of property taxes, increased by 157 percent over the past decade. Local employee contributions increased by only 35 percent over the same period.

• In Illinois’ 20 largest cities, taxpayers currently contribute three times more into local pensions than local employees do.

• In Illinois’ 20 largest cities, total unfunded pension liabilities doubled over the past decade to more than $4,000 per household.

• Police and fire pension funds are effectively bankrupt, with less than 55 cents on hand for every dollar they need to pay for retirements.

Virtually all cities in Illinois are in crisis.

Without real pension reform, the financial condition of cities across Illinois will continue to deteriorate. The collapse of city budgets is a lose-lose situation for taxpayers, city retirees and those dependent on core government services.

Download this link to learn more about your local pension system.