Taxpayers on the hook for billions in hidden government-worker health-care costs

By Benjamin VanMetre, John Klingner

Download Report

The problem

Skyrocketing retirement costs for Illinois’ state and local government workers are wreaking havoc on governments’ ability to provide core services such as public safety, education and infrastructure. States and cities across the nation continue to struggle with massive pension and health-care costs, which force residents to pay higher taxes and fees to receive diminished services.

For decades, state and local governments hid the true amount of debt for which taxpayers are on the hook. Most reporting standards allowed governments to keep a majority of their debt off the books – including the total owed for government worker pensions and retiree health-care costs. But now that debt is coming due, and residents and watchdogs are demanding transparency.

The Governmental Accounting Standards Board, or GASB, which sets accounting rules for governments, aims to provide that transparency. The board is requiring governments across the country to report their true levels of debt going forward. In 2012,GASB approved new accounting rules for governments to disclose their pension debt on their balance sheets. 1

Now GASB is issuing a new ruling to make governments report the debt related to health benefits promised to government retirees. Referred to as Other Post-employment Benefits, or OPEB, these benefits include retiree health-care benefits such as life insurance, disability, legal and other services.

According to GASB Chair David A. Vaudt: “OPEB – which consists mainly of health care benefits – represents a very significant liability for many state and local governments, one that is magnified because relatively few governments have set aside any assets to pay for those benefits.”

Illinois is one the biggest offenders in the country when it comes to unfunded OPEB liabilities.

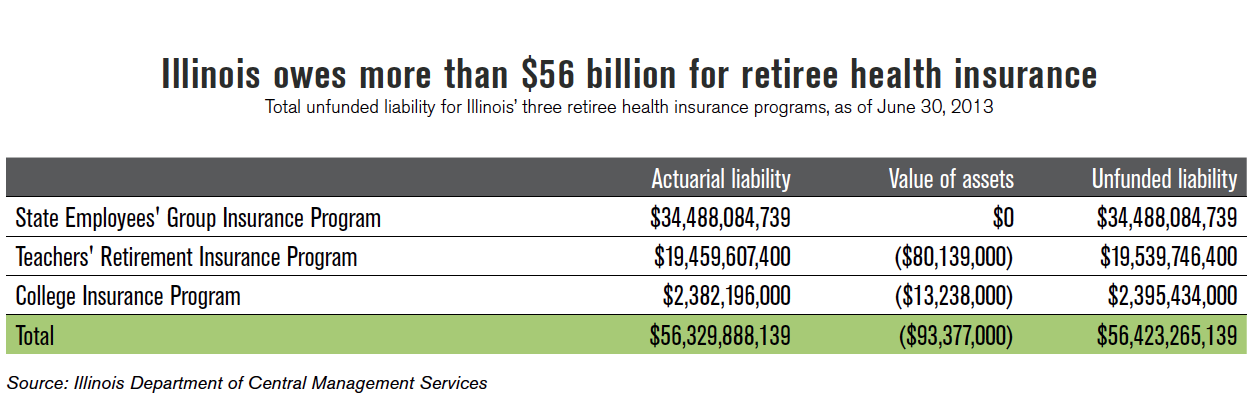

Illinois’ OPEB liabilities have grown by more than $16 billion since 2007 – totaling more than $56 billion today.2 Unfortunately,the state hasn’t put aside any money to pay for those benefits. 3And like many other states, Illinois doesn’t report this number on its balance sheet.

Unfunded OPEB liabilities are an issue for Illinois’ local governments as well. Local OPEB liabilities for downstate public retirees now exceed $10 billion.4

The drivers of this debt at both the state and local level include overly generous benefits and state-government retirees contributing little to nothing to pay for those benefits. These problems are compounded by the fact that OPEB liabilities are generally kept off the balance sheet – making it easy for governments to hide this debt from the public eye.

OPEB liabilities at a glance

In general, OPEB liabilities have not received the same level of attention as unfunded pension liabilities. But ratings agencies have recently started to emphasize the impact these liabilities can have on state budgets. Standard & Poor’s Ratings Services warned that OPEB liabilities can be a significant source of “credit pressure” for states, which means they can negatively affect a state’s credit rating.

OPEB liabilities make up about one-third of long-term liabilities across the 50 states.5 States are collectively on the hook for about $529 billion in unfunded OPEB obligations, according to S&P.6

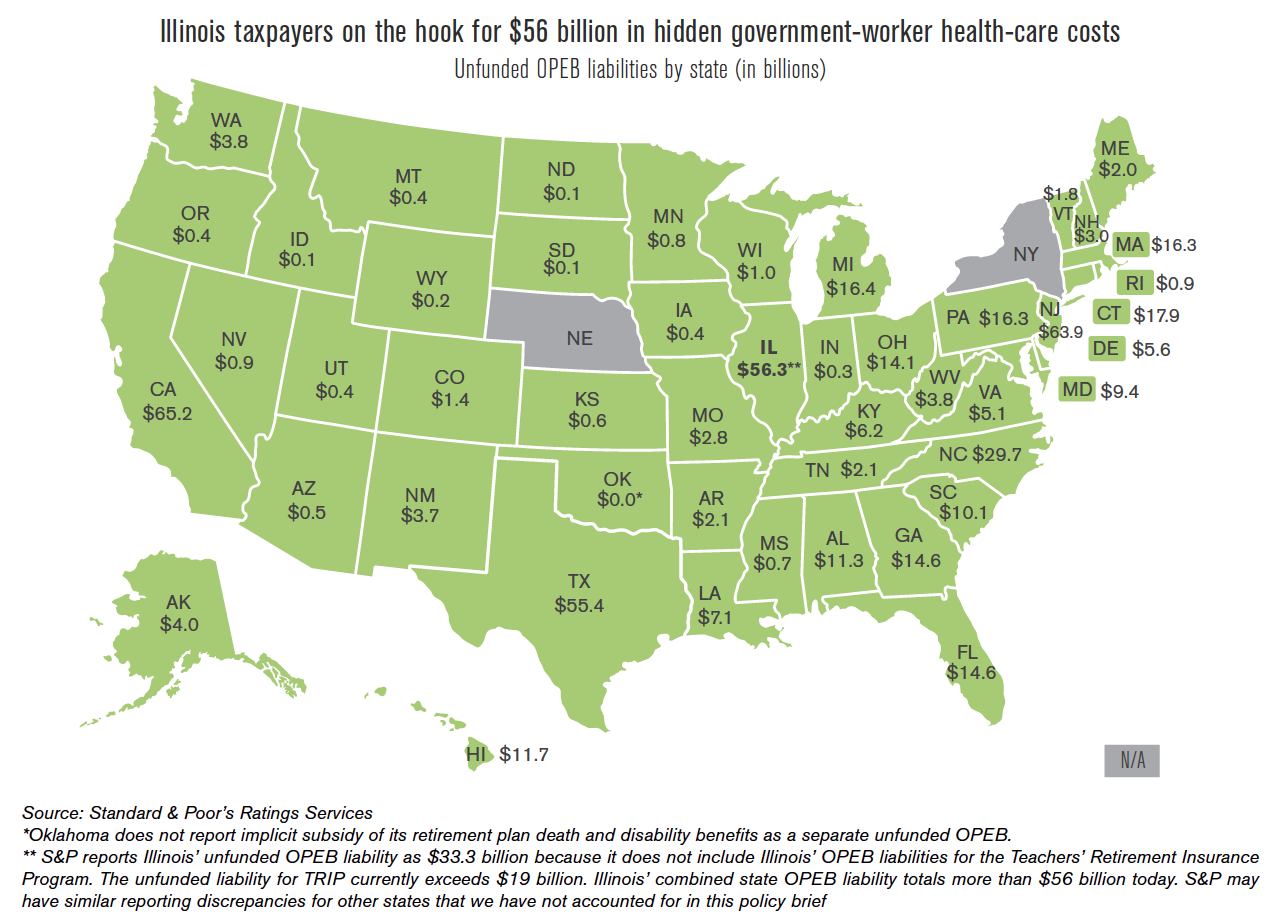

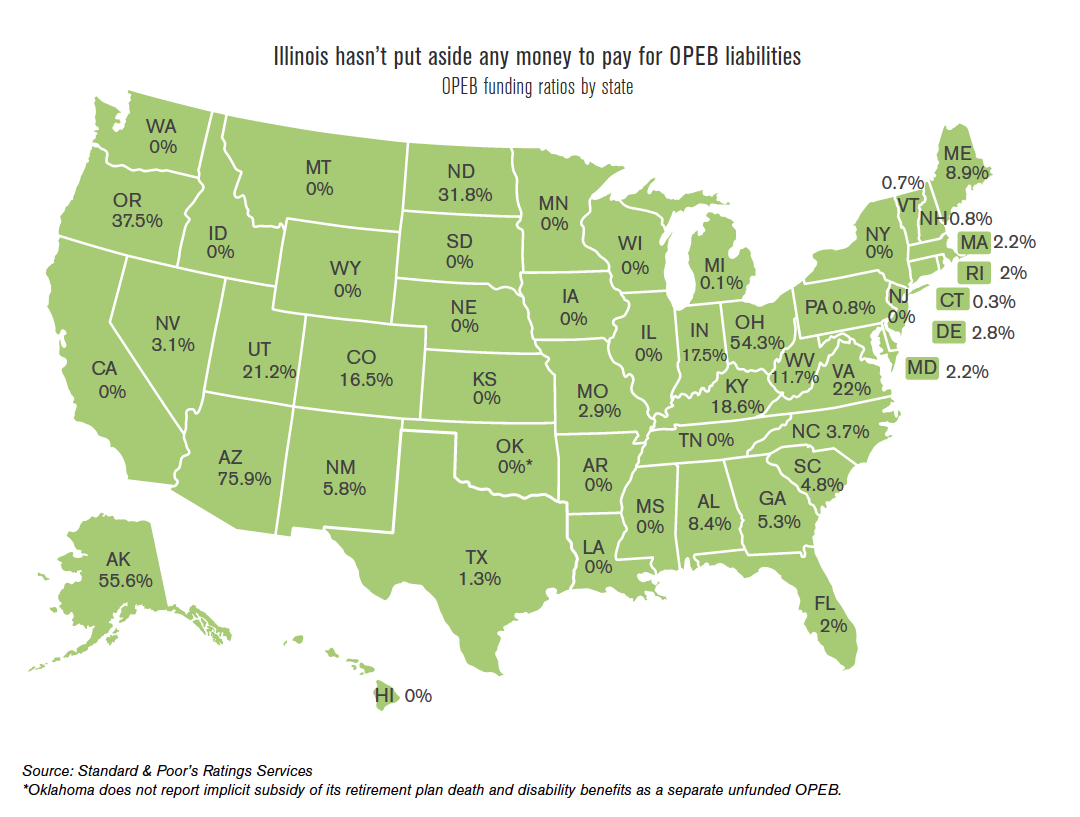

That $529 billion liability is made up of two types of OPEB systems – prefunded OPEB and pay-as-you-go OPEB. Thirty states prefund their OPEB systems, with funding ratios ranging from 0.1 percent (Michigan) to 75.9 percent (Arizona). Pay as-you-go states are zero percent funded.States with the highest unfunded OPEB liabilities include:

- New York: $66.5 billion

- California: $65.2 billion

- New Jersey: $63.9 billion

States with the lowest unfunded OPEB liabilities include:

- Oklahoma: $4 million

- South Dakota: $66 million

- Idaho: $85 million

The way S&P determines unfunded liabilities varies across the states. In Illinois, for example, S&P does not report OPEB liabilities for the Teachers’ Retirement System – lowering the unfunded liability in the graphic below. 7

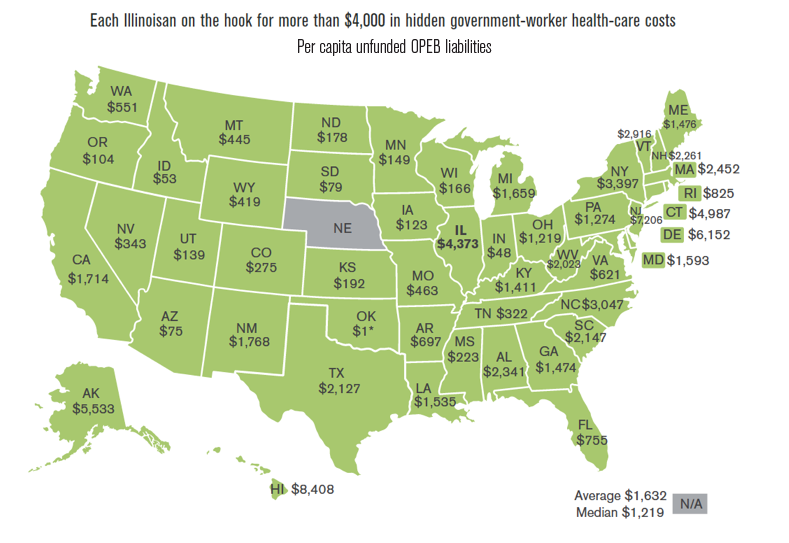

The average per capita unfunded OPEB liability is $1,632. States with the highest per capita unfunded OPEB liabilities include:

- Hawaii: $8,408 per capita

- New Jersey: $7,206 per capita

- Delaware: $6,152 per capita

States with the lowest unfunded OPEB liabilities include:

- Oklahoma: $1 per capita

- Indiana: $48 per capita

- Idaho: $53 per capita

Thirty-nine states have less than 10 percent of the assets they need in the bank today to pay for the benefits they’ve promised. Only three states have funding ratios above 50 percent: Arizona (75.9 percent), Alaska (55.6 percent) and Ohio (54 percent)

Illinois is one of 20 states with OPEB systems that are zero percent funded.

OPEB benefits in Illinois out of sync

OPEB benefits in Illinois are out of sync with the private sector and with what retirees pay in other states.

State government retirees in Illinois contribute little to nothing toward their health insurance plans, yet they are able to retire in their mid-50s and receive full health insurance coverage. This benefit is virtually unheard of in the private sector, where taxpayers have to pay for their own health insurance and cover the same cost for government retirees.

Government retirees in other states pay closer to half of their OPEB benefits. According to a 2010 survey of health benefits, states pay, on average, about 46 percent of retiree health premiums for their Medicare-eligible and non-Medicare-eligible retirees.8

Granting health insurance benefits without asking government workers to pay for them is no longer affordable or sustainable in Illinois.

Continuing to push off reform to future generations may be a politically safe approach for lawmakers who do not wish to make tough financial decisions. But that approach is unfair to the taxpayers who are footing the bill for generous benefits that most do not receive themselves.

New GASB reporting requirements

Most reporting standards have allowed governments to keep the majority of their debt off the books. But GASB recently proposed new reporting rules to shine light on the true magnitude of OPEB liabilities. The rules include:

- Put OPEB liabilities on the books: GASB’s new reporting requirements provide a specific framework for states to measure their long-term OPEB liabilities and the associated costs. These reporting requirements will provide much needed transparency for the media, watchdogs and taxpayers to understand the stress these liabilities can have on budgets and core services. And the new requirements will help ratings agencies better determine the financial health of state and local governments.

- Discount rates: Discount rates play a major role in determining a state’s OPEB debt. Using higher rates can make the debt burden appear smaller, while lower rates have the opposite impact. GASB’s new rules require states to use municipal bond rates or tax-exempt, high-quality 20-year general obligation municipal bond index rates – similar to the recently issued GASB pension standards. Using those discount rates will provide a more accurate picture of government OPEB liabilities.

- Reporting assumptions: GASB reporting standards would require states to disclose, among other things:

- Descriptions of the OPEB plan, the benefits provided, and the authority that established the plan and requires contributions to it

- Significant assumptions used in measuring the total OPEB liability

- Descriptions of benefit changes and changes in assumptions

- Discount rates and the projection period selected

- Sensitivity analyses that show how changes in the discount rate impact OPEB liabilities

Our solution

The new GASB reporting requirements will help shine a light on the true size and cost of OPEB liabilities. But the requirements do not require states to structurally reform their quickly growing OPEB costs. Lawmakers should bring Illinois’ health-care benefits in line with other state governments and the private sector. Doing so will ensure the long-term stability of these benefits while also addressing the state’s looming budget crisis. Specifically, lawmakers should:

- Increase contributions: Increase retiree contributions toward premiums to match the average payments of retirees in other states. Increasing the average retiree contribution to 54 percent of the total OPEB costs could save the state about $800 million in fiscal year 2015.

- Cap retiree subsidies: Capping retiree subsidies at $4,000 per enrollee, for example, could achieve similar savings. Lawmakers could establish a lower cap for dependents, retirees younger than 65 and retirees earning six-figure pensions.

- Means-test retiree subsidies: State lawmakers should consider further increasing retiree contributions or ending taxpayer-funded subsidies for retirees earning six-figure pensions.

Why it works

Putting OPEB liabilities on the books will make it more difficult for state and local governments to hide OPEB costs – which are a growing share of their debt burden. The new GASB reporting requirements will make it easier for media, watchdogs and taxpayers to understand the stress OPEB liabilities have on budgets and core services. The requirements will also give bond holders a better understanding of the risks associated with investing in state and local governments.

In addition to the new reporting requirements, structurally reforming OPEB benefits going forward will dramatically reduce the unfunded OPEB liability, protect taxpayers and help prevent indiscriminate cuts to core government services. Bringing Illinois’ OPEB benefits in line with those of governmental employees in other states is a necessary first step in achieving these goals. Moreover, legal analyses suggest that such changes are entirely permissible under state law.9

Guarantee of quality scholarship

The Illinois Policy Institute is committed to delivering the highest quality and most reliable research on matters of public policy.

The Institute guarantees that all original factual data (including studies, viewpoints, reports, brochures and videos) are true and correct, and that information attributed to other sources is accurately represented. The Institute encourages rigorous critique of its research. If the accuracy of any material fact or reference to an independent source is questioned and brought to the Institute’s attention in writing with supporting evidence, the Institute will respond. If an error exists, it will be corrected in subsequent distributions. This constitutes the complete and final remedy under this guarantee.