Saving Chicago: Pension reform without tax hikes

By John Klingner, Benjamin VanMetre

Download Report

Chicago politicians have exploited city-worker pensions for nearly two decades.

They’ve used the city’s pension systems as slush funds and pension benefits as bargaining chips to further their own agenda, with seemingly no regard for Chicago’s fiscal health.

Now those pension systems are nearly insolvent and the city is heading toward bankruptcy. Chicago is facing an onslaught of credit downgrades, billion-dollar budget deficits and grim comparisons to Detroit.

Politicians control Chicago’s pension systems, and they’ve run them into the ground.

It’s time to take that control away and put it where it belongs – with city workers.

Just look at the mess politicians have made.

The police officers’ fund has just $0.25 for every dollar required to pay out future benefits. The firefighter fund, just $0.31.

They are among the worst-funded pensions in the nation, and with no real plan to fix them, it’s only a matter of time before they run dry.

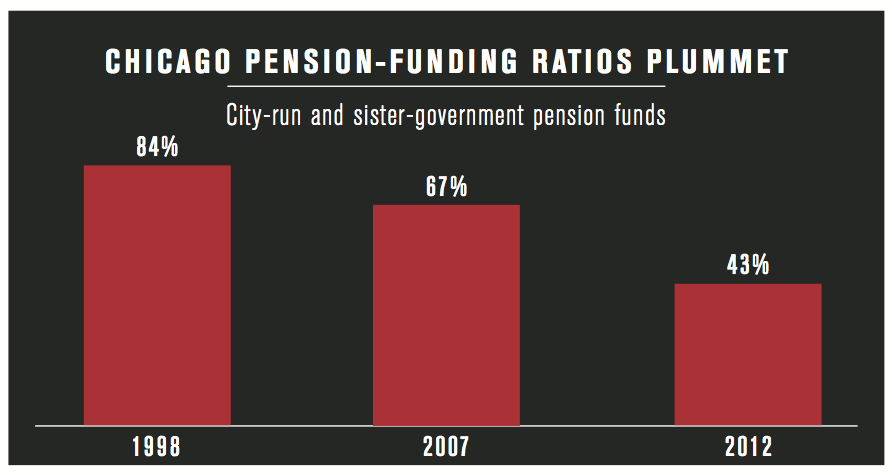

The city’s laborers and teachers, as well as transit, park and municipal workers, all find themselves in the same predicament. Collectively, the city’s pension funds have less than half the money required to meet their future obligations.

Chicago’s official pension shortfall is now $29 billion. Detroit, by comparison, had just a $3.5 billion shortfall when it filed for bankruptcy last year.

Not surprisingly, the rating agencies have caught on. Moody’s Investors Service slashed Chicago’s credit rating in March, leaving it just three notches above junk status. Of the nation’s largest cities, only Detroit has a worse rating.

Chicago’s embarrassing fall can be traced to a host of reckless acts by the political elite. Here are some examples:

Skipped payments: In 2010, politicians passed a three-year pension “holiday” that allowed Chicago Public Schools, or CPS, to skip $1.2 billion in pensions contributions to the teacher pension system.

Politicized pensions: Politicians also barter salary and pension benefits in exchange for union political support, with no regard to whether taxpayers can afford the increased costs. That’s driven up city and sister government payroll costs by 20 percent since 2004, despite an overall 12 percent cut in total employment. And the average 30-year career city worker who retires today expects nearly $2 million in benefits over his or her lifetime.

Chicagoans will be paying for this recklessness through higher taxes. In 2015, taxpayer contributions to city-run and sister-government pensions will double to $3 for every $1 city employees put in. And most pension reform plans on the table call for even higher property taxes.

But there’s also a social cost to this recklessness, seen prominently in the indiscriminate cuts already being made to core government services.

Chicago students have 50 fewer schools to attend and nearly 3,000 fewer teachers and staff to learn from as a result of a massive budget cuts driven largely by pension costs.

Residents in neighborhoods with crumbling streets and growing potholes have to wait longer for repairs. The city has 2,000 fewer municipal worker positions today than it did in 2004.

And Chicago’s effort to battle crime faces even more challenges, with 1,500 fewer police officers and staff protecting neighborhoods and families compared to eight years ago.

Chicago’s deepening crisis will soon force politicians to decide between two paths.

The first is to use tax hikes to prop up a failed system run by the same politicians who bankrupted it in the first place.

The second is to give workers control over their own retirements, and to make the tough choices necessary to bring about real retirement security for Chicago’s city workers.

The Illinois Policy Institute’s proposal follows the second path. It aims to end the city’s crisis and to preserve Chicago’s status as a world- class city.

THE SOLUTION

The Illinois Policy Institute’s holistic plan puts Chicago back on a path to financial security. The plan achieves this by ending the political mismanagement of pensions that has left the city with more than $29 billion in pension debt, dangerously underfunded pensions, retirement benefits that are no longer affordable and fewer resources for core government services.

The plan’s first step is to take control of retirements away from politicians and put it in the hands of city workers. Going forward, workers will own and control a hybrid retirement plan that contains two key elements: a self-managed plan and a Social Security-like benefit. The plan is careful to protect benefits that have already been earned by current workers and retirees under the existing pension plan.

By moving to a hybrid pension plan, retirement costs will become a more stable and predictable portion of city budgets, helping prevent indiscriminate cuts to core government services. And taxpayers would no longer be subject to paying higher taxes to fund ever-growing pension shortfalls.

1. Hybrid retirement benefits: Going forward, workers are given ownership and control over individualized, portable retirement accounts. The plan gives workers a hybrid retirement plan that allows them to benefit from market returns, but also provides them with the stability offered by fixed monthly, Social Security-like benefits.

- Self-managed plan: Workers contribute 8 percent of their salary toward a portable retirement investment account. The employee contribution will be deposited into the employee’s retirement account each pay period. Investments will be made at the employee’s discretion.

- Social Security-like benefit: Employers will contribute a matching 7 percent of salary to their employees’ retirements each pay period. The employer contribution will be used to purchase a Retirement FIRST (Fixed Income Retirement Security you Trust) contract each year from an insurance company. These contracts will provide the employee with a fixed monthly, Social Security- like benefit during retirement.

2. Current benefits: The plan ensures already-earned pension benefits are protected.

- Current workers: Pension benefits already earned will be preserved and paid to workers upon retirement. All future benefits will accrue under the new hybrid retirement plan.

- Current retirees: Retiree’s will continue to receive their pension benefits and already accrued cost-of-living adjustment, or COLA, increases.

3. Cost-of-living adjustments, or COLAs: Reforming COLAs is the single-largest lever for reducing the city’s massive pension debt, but any reform must protect career workers with limited annual pensions. Means-testing is the most effective and equitable way to reform COLAs.

The Illinois Policy Institute’s reform plan protects cost-of-living adjustments, or COLA, benefits of career workers who dedicated more than 30 years to the city and earn annual pensions of less than the maximum annual Social Security payment for a private -sector worker who’s reached the full retirement age. Retirees earning pensions exceeding the maximum Social Security benefit – currently at approximately $32,000 – will not receive additional COLA increases until the pension systems are fully funded. Any already-accrued COLA increases, however, will be preserved.16

4. Retirement age: This plan aligns the retirement age for city workers with the private sector. The age at which workers can begin collecting a pension is based on how close workers are to retirement under current law and how many years they’ve dedicated to the city. The plan protects the retirement ages of longtime employees who are already nearing retirement. The closer employees are to their current legal retirement age, the fewer additional years are added to that retirement age, provided the new age will be no lower than 59 (due to the nature of their work, Chicago’s police and fire employees will retire at an earlier age). Younger workers will be given more time to plan and budget for changes in the retirement age.

THE RESULTS

The city of Chicago contributes to four city-run pension funds: police, fire, laborers and municipal workers. Chicago taxpayers are also responsible for funding the pensions of the city of Chicago’s sister governments: Chicago Public Schools, the Chicago Park District and the Chicago Transit Authority.

For simplicity, this analysis focuses exclusively on the four city-run funds. Separate results for the Chicago Teachers’ Pension Fund are included in Appendix 4.

The Illinois Policy Institute’s plan:

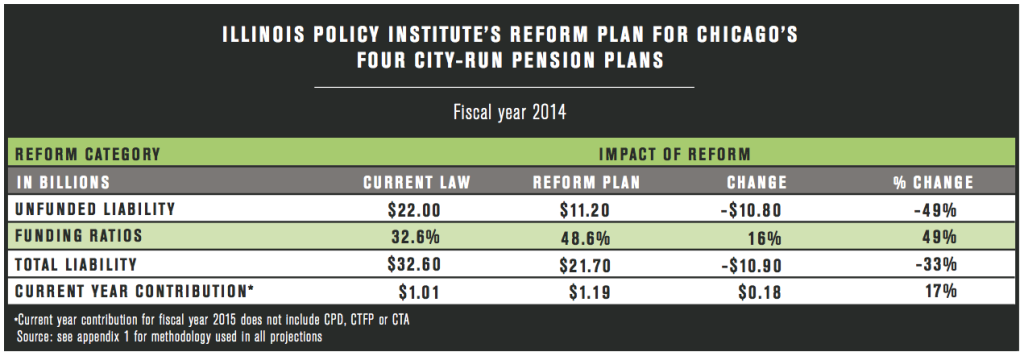

- Dramatically improves the funding ratio of the four city-run plans. The funding ratio immediately increases by nearly 50 percent – to 48.6 percent from 32.6 percent – quickly enhancing the overall health of the pension systems.

- Immediately reduces the unfunded liability by nearly half, to $11.2 billion, and stops future growth in the accrual of defined- benefit liabilities.

- Pays down the remaining unfunded liability in flat annual installments based on an Annual Required Contribution. The ARC contributions fully fund the systems in 30 years. These contributions make retirement costs a more stable and predictable portion of city budgets and help prevent indiscriminate cuts to core government services.

Getting Chicago’s pension shortfall under control

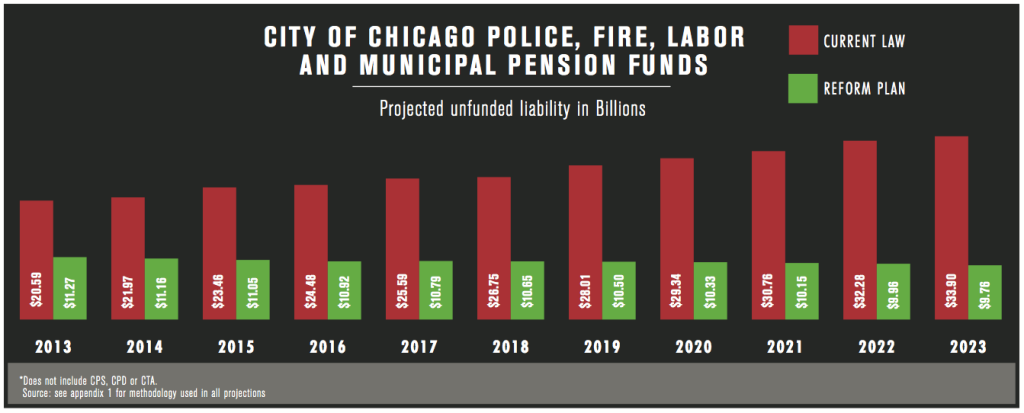

Reducing the city’s unfunded liability to a sustainable and affordable level is an essential component of real pension reform. The Illinois Policy Institute’s reform plan immediately reduces the unfunded liabilities by 45 percent, to $11 billion. The plan further reduces the unfunded liability by another 13 percent, to $9.76 billion over the next decade.

In contrast, despite massive increases in contributions, the city’s $20 billion in unfunded liabilities jumps by 65 percent over the next decade under current law.