Progressive tax hike would hurt middle-class Illinoisans

Lawmakers and special-interest groups across Illinois are trying to dupe Illinoisans into paying higher income taxes. They’re trying to convince Illinoisans that a progressive income tax hike is only a tax hike on the rich. But that couldn’t be further from the truth. Need proof? Look at both progressive tax proposals on the table in...

Lawmakers and special-interest groups across Illinois are trying to dupe Illinoisans into paying higher income taxes. They’re trying to convince Illinoisans that a progressive income tax hike is only a tax hike on the rich. But that couldn’t be further from the truth.

Need proof? Look at both progressive tax proposals on the table in Illinois.

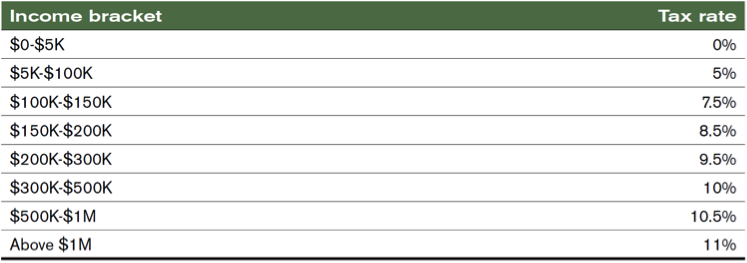

Under current Illinois law, the individual income tax rate will be 3.75 percent in 2015. Under the progressive tax-hike plan from state Rep. Naomi Jakobsson, D-Champaign, a higher 4 percent rate kicks in on any income of more than $18,000. That income tax rate targets hardworking Illinoisans.

Jakobsson’s progressive tax rates also attack the middle class. Her 5 percent tax rate applies to income earned after $36,000. When an Illinoisan earns more than $58,000, Jakobsson’s tax rates jump to 6 percent, and again to 7 percent on income earned after $95,000 – nearly double the rate Illinoisans will pay in 2015.

Source: Email correspondence with state Rep. Naomi Jakobsson

Another progressive tax plan, developed by the union-funded Center for Tax and Budget Accountability, increases the tax rate for anyone who earns more than $5,000.

Source: IEANEA

It’s no surprise that Jakobsson’s progressive tax-hike proposal targets the middle class – it’s how progressive income taxes work. That’s where a lot of the money is.

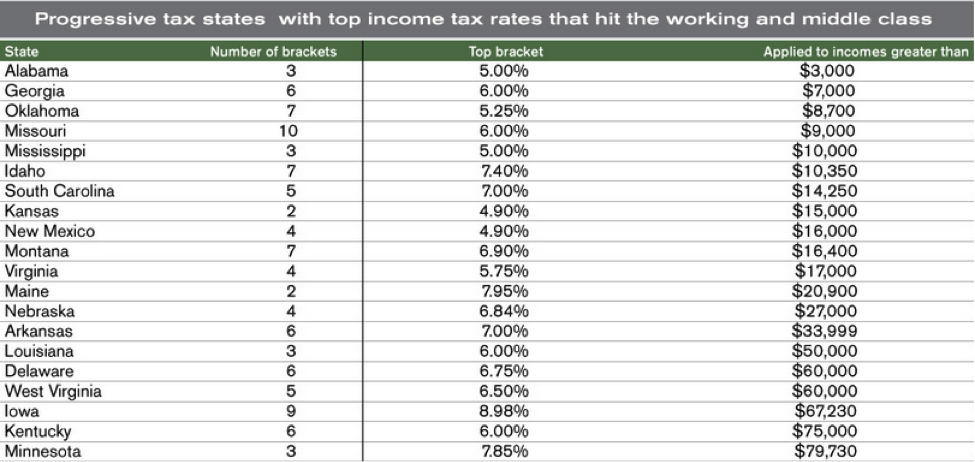

Just look at where the top progressive tax rates – the rates that are supposed to “make the rich pay their fair share” – start in other states.

Source: Tax Foundation Facts & Figures 2013

So don’t be fooled when lawmakers say a progressive income tax is only a tax on the rich. The proposed rates in Illinois make it clear that lawmakers are gearing up to raise tax rates on Illinois’ working- and middle-class residents.