Pritzker doubles down on progressive income tax, says Illinois needs $3.7B tax hike ‘now more than ever’

Despite a massive national economic contraction, Pritzker is resisting calls to pull a large tax hike from the November ballot.

As Illinois battles the public health and economic consequences of the COVID-19 outbreak, Gov. J.B. Pritzker is insisting on pushing forward with his progressive income tax proposal.

In an April 15 press conference, NBC-5 reporter Mary Ann Ahern asked Pritzker if it was time to reconsider his progressive income tax hike. Instead of considering the possibility of removing the amendment from the November ballot, the governor said Illinois “need[s] it now more than ever.”

Contrary to Pritzker’s claim, massive job losses and soaring unemployment claims statewide mean there might not be a worse time for a tax hike. Hiking taxes during a recession, or just as the economy attempts to get back on its feet, would be a clear policy mistake.

Experts agree: Don’t hike taxes during a recession

Gov. J.B. Pritzker has repeatedly said his response to COVID-19 has been informed by science. But a massive income tax hike in the midst of the most sudden and severe downturn since the Great Depression is counter to what economic experts recommend.

Economists are in near-unanimous agreement: reducing the harm of recessions requires expansionary monetary and fiscal policy. That means avoiding tax hikes while spending on the programs Illinoisans truly need.

This approach is bipartisan. In 2009, then-President Barack Obama responded to a question about evidence for hiking taxes in a recession as follows: “[The questioner’s] economics are right. You don’t raises taxes in a recession.”

Illinois is facing a $4.6 billion decline in revenues, according to the Governor’s Office of Management and Budget. Some experts suggest attempting to offset the decline in revenue through higher taxes would be the most costly way of closing the gap for the state’s economy.

Pursuing an income tax hike to offset COVID-19-related revenue losses would diminish Illinois’ chances for a strong, V-shaped recovery. Instead, Illinois’ economy would likely continue to struggle and lead to more prolonged stagnation in state finances – risking another lost decade due to poor policy choices.

In order to avoid spending cuts to programs many Illinois families rely on, and to stave off tax hikes that will hamstring the economy as it attempts to recover, Illinois can free up billions of dollars in the state budget through pension reform.

Low-income Illinoisans still suffering

One of the primary arguments Pritzker has made in favor of his progressive income tax proposal is that the state needs to provide tax relief to lower- and middle-income Illinoisans. The governor often argues that the state’s current income tax structure is regressive and leads to lower-income Illinoisans paying the same tax rate as billionaires like him. He further argues his “fair tax” proposal would address this inequality.

However, analysis by the left-leaning Institute for Taxation and Economic Policy shows this isn’t true.

The effective income tax rate (the total income tax rate after accounting for exemptions and deductions) for the lowest 20% of income earners in Illinois is 1.5% while the effective income tax rate for the highest income earners is 4.1%.

Under the governor’s proposal, the effective income tax rates for Illinoisans in the bottom 20% would remain virtually unchanged, dropping to 1.44%. In fact, if voters approve Pritzker’s proposal, Illinois will have the 3rd highest state and local tax burden on the lowest 20% of income earners in the nation – unchanged from its ranking prior to the new tax structure.

With virtually no change in income taxes for the poorest Illinoisans, the state’s recently enacted tax and fee hikes will completely erase any promised tax savings. The tax burden on these Illinoisans will instead continue to rise because of these tax hikes and the constant increase in Illinois property taxes, which are the second highest in the nation.

The reality is that offsetting the expected income tax revenue losses under the currently proposed progressive income tax structure means raising taxes on even the poorest Illinoisans.

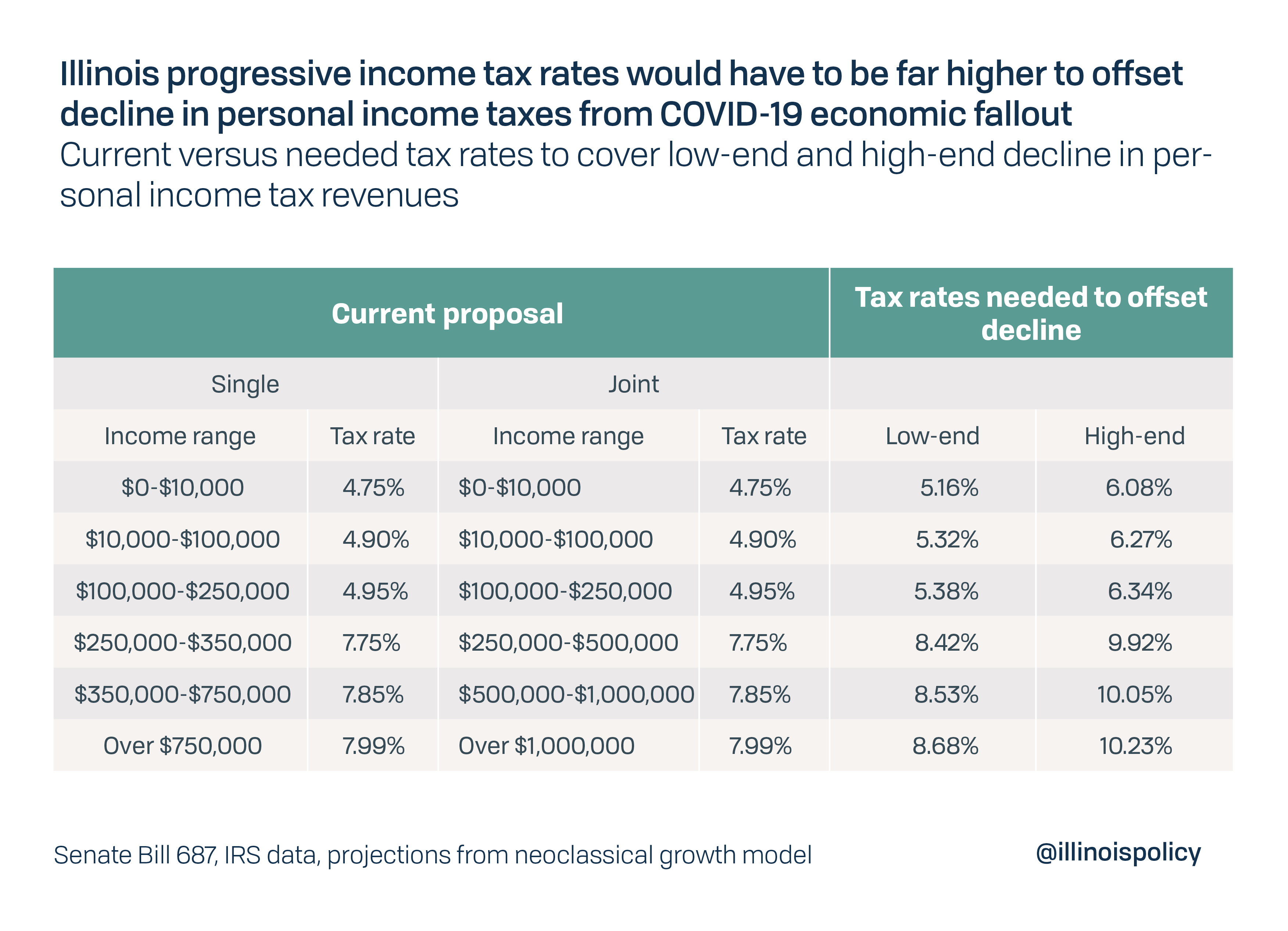

For the progressive tax to offset Illinois’ new projected decline in income tax revenue, marginal income tax rates would have to range from 5.16% to 8.68%. And that’s at the low end of the estimated gap. In the worst-case scenario, tax rates would have to be far higher, ranging from 6.08% to 10.23%. A tax increase along those lines would represent a $286 to $1,056 income tax hike for the typical Illinois family, who made $81,313 in 2018.

Suffocating small businesses

New research shows fewer than half of all U.S. small businesses – those with fewer than 500 employees – expect to be re-opened this year if the crisis lasts more than four months.

For the small businesses that do manage to survive, the last thing their owners and employees need is a tax hike to crush them while they’re attempting to get back on their feet.

The income tax hike would hit that state’s largest job creators – small businesses – the hardest. Small businesses are responsible for 60% of the net job creation in Illinois and are the businesses most at risk from the economic fallout of COVID-19. Unfortunately, the progressive income tax hike would be the largest for these businesses. While the total corporate income tax rate – including the Personal Property Replacement Tax – will be hiked by 10% (from 9.5% to 10.49% when including PPRT), the tax hike for pass-throughs could be up to 47% (6.45% to 9.49% when including PPRT).

Research has shown that an increase in the top marginal tax rate is associated with a decrease in hiring activity of entrepreneurs and lower wages for their employees.

Without continued relief provisions from the state government, businesses will struggle to survive, and job creation in Illinois will remain subdued as other states do their best to recover.

A revenue roller coaster

While the governor promised $3.7 billion in new income tax revenue from his tax plan, the current economic downturn will mean the tax yields less revenue than he anticipated.

The downturn has also highlighted one of the many flaws with progressive income taxes: they are far more volatile than flat income taxes. According to estimates from the Governor’s Office of Management and Budget, a progressive income tax would see revenues decline in the economic crisis by 18.2%, compared with the governor’s original forecast. Meanwhile, revenues under the current flat income tax are projected to fall 8.8%.

The larger anticipated decline in revenues means the progressive income tax would exacerbate the state’s budgetary troubles.

Illinois has virtually no rainy-day fund. The state’s budget stabilization fund currently has $1.19 million, enough to cover just over 15 minutes of state spending. The state has also become increasingly reliant on the income tax – a less stable source of revenue – in recent years, making the state budget more susceptible to downturns. If the state continued with current spending habits and failed to keep a rainy-day fund, large downturns in revenue from the progressive income tax would lead to larger budget deficits and likely increase the likelihood of middle-class tax hikes.

Fails to close the budget hole

Updated revenue forecasts show the state is anticipating to have a $7.4 billion budget gap in fiscal year 2021. Pritzker has used this as another justification to raise income taxes this year, potentially in the middle of a recession. However, Illinois’ budget hole would still be $6.2 billion if voters approve Pritzker’s tax hike, and the extra revenue would come at the cost of inflicting additional damage on the state economy.

Instead, a pension reform plan proposed by the Illinois Policy Institute could immediately save the state $2.4 billion in pension contributions to add some cushion to the budget, without taking away a dollar of the annual benefits earned to date by public workers. While a necessary constitutional amendment would take time to enact, if lawmakers passed the amendment now to be put on the ballot in November, they could change the funding ramp immediately to match what actuarial contributions would be after reform.

Instead of enacting a dangerous income tax hike that would kneecap any potential economic recovery, Illinois should protect its flat income tax and lawmakers should remove the question from the ballot. Contrary to the governor’s claims, a progressive income tax hike is the last thing Illinois needs right now.