Pensions: contributions out of sync with payouts

Members of Illinois’ state-run pension systems claim they’ve paid their fair share into the pension funds. To be sure, these workers have paid in what’s been required legally under mutually agreed upon contracts. But the benefits politicians and union bosses have negotiated for retirees are pushing the state’s pension systems to the brink of insolvency....

Members of Illinois’ state-run pension systems claim they’ve paid their fair share into the pension funds.

To be sure, these workers have paid in what’s been required legally under mutually agreed upon contracts.

But the benefits politicians and union bosses have negotiated for retirees are pushing the state’s pension systems to the brink of insolvency.

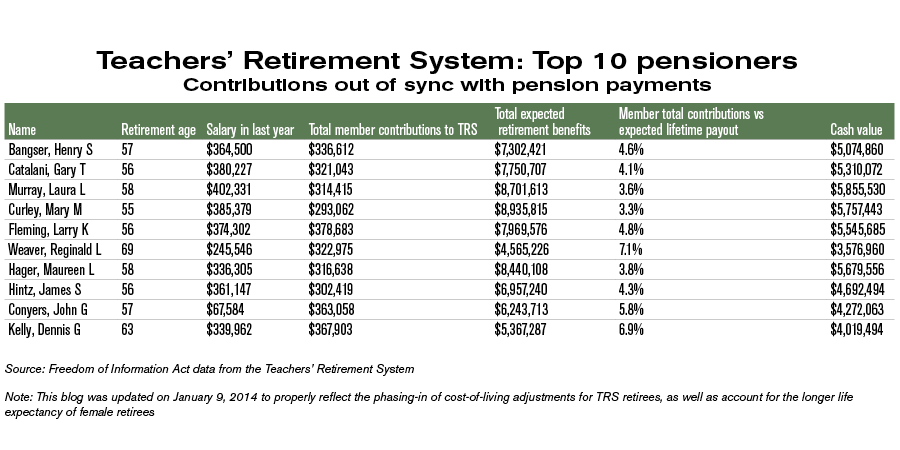

A look at the pension of Henry Bangser, the ex-superintendent of New Trier High School and the Teachers’ Retirement System’s highest pensioner, reveals just how out of sync worker contributions are with the benefits they receive.

Bangser will receive $7.3 million in pension benefits during his retirement, which began at the age of 57.

Yet he contributed just $336,000 to the pension system over his 30-plus year career, an amount less than his final salary of $364,500 in 2007 and just 4.6 percent of his expected lifetime benefits.

That’s the problem with the current system: worker contributions are far too small relative to the pension benefits they’ll receive during their lifetimes. Not only that, but the state’s defined benefit pension plan forces young workers to contribute to a system that may collapse by the time they are ready to retire. Illinois’ pension systems are nearing insolvency and only have $0.40 of every dollar needed to make future payments.

With every paycheck, a state employee contributes a fixed percentage of his salary to the pension system. Over his entire career, his total worker contributions are based on his average salary.

However, pension benefits aren’t based on those contributions. Instead, they’re based on a worker’s end-of-career salary, when it’s likely to be at its highest point due to experience and end-of-career spikes.

Bangser’s total compensation spiked during his last 10 years of work, driving up his lifetime pension benefits significantly.

Systemic

Henry Bangser’s experience with Illinois’ defined benefit pension system is not unique. A similar scenario takes place in the pension calculation of each and every pension in Illinois’ five state-run systems.

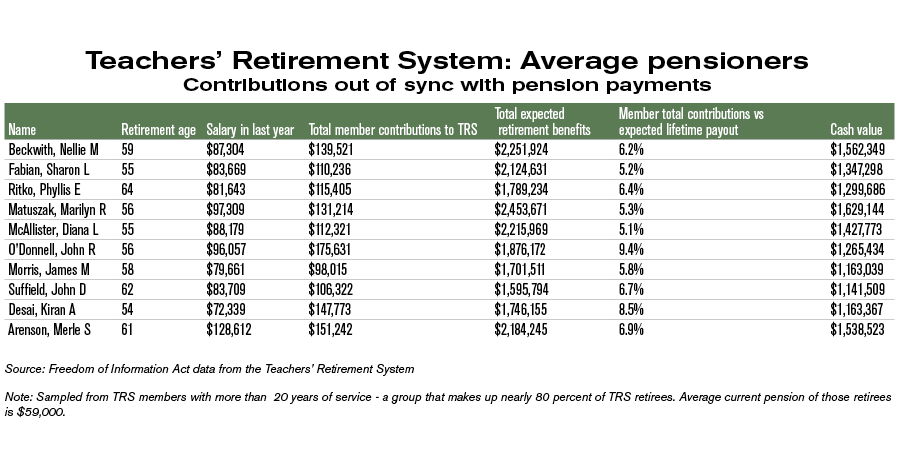

For example, TRS members with more than 20 years of service — a group that makes up nearly 80% of all TRS retirees — receive average pensions of $59,000. Some of these retirees will receive pension benefits exceeding $2 million during retirement.

To put retirement benefits into perspective, an individual in the private sector would need to have more than $1 million in the bank when he retires to receive similar benefits.

Cost-of-living adjustments and the retirement age for Illinois government workers make this problem worse.

Automatic compounded cost-of-living adjustments allow retirees to double their pensions after 25 years. And since more than half of all the state’s 200,000 annuitants retired at 59 or younger and are expected to live past 81, a doubling of pensions is becoming more common.

These benefits and the defined benefit system they are based on were never affordable. Despite the fact that retirees have contributed their required amount, it’s becoming increasingly clear these benefits are not fair.

It’s hardly fair to ask the younger workers, whose pension checks may be cut in the future, and taxpayers, who fund these generous retirements, to bailout pensions; it’s also unfair to the poor and disadvantaged who are forced to deal with more cuts to core government services.

The current reform plans under consideration by Illinois’ conference committee don’t address the real issue of Illinois’ pension crisis — the failed defined benefit system.

A real solution must have at its center 401(k)-style plans that give workers control of their own retirements.

That’s the only fair way to protect the retirements of Illinois’ current workers and retirees, as well as Illinois’ solvency.

* This blog was updated on Jan. 9, 2014, to properly reflect the phasing-in of cost-of-living adjustments for TRS retirees, as well as to account for the longer life expectancy of female retirees.