Parks and wreck

The Illinois General Assembly today approved a pension bill that requires taxpayers to pay an additional $75 million into the Chicago Park District pension fund in addition to tripling the taxpayer contribution to the troubled pension fund. Unfortunately, this bill is mistakenly being heralded by some as a potential model for pension reform. Make no mistake:...

The Illinois General Assembly today approved a pension bill that requires taxpayers to pay an additional $75 million into the Chicago Park District pension fund in addition to tripling the taxpayer contribution to the troubled pension fund.

Unfortunately, this bill is mistakenly being heralded by some as a potential model for pension reform.

Make no mistake: This bill is bad for workers and taxpayers. It will most likely result in higher taxes and fees for city residents, but no greater level of retirement security for park district workers.

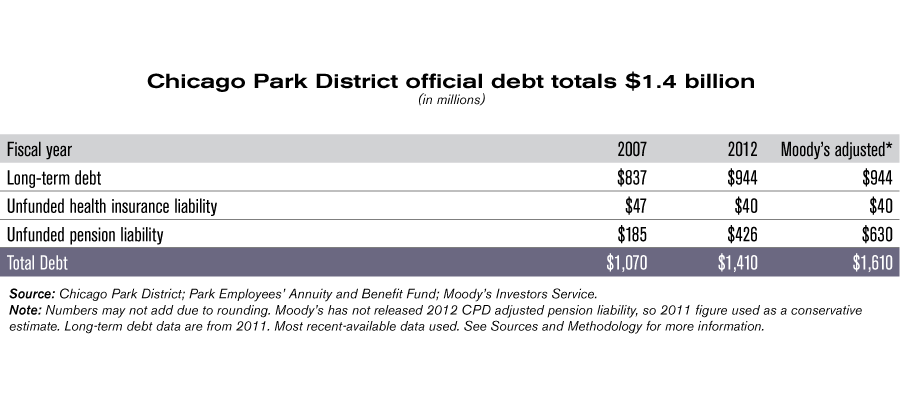

The Chicago Park District has more than $1.4 billion in official debt. This includes $40 million in debt related to retiree health care, $426 million in pension debt and $944 million in other long-term debt.

Unfortunately the bill passed today by the Illinois General Assembly does not adequately reform the Chicago Park District’s troubled pension system. It fails the litmus test for reform because it does not fundamentally change the way that the pension system is run.

Here are some reasons why this bill is bad for taxpayers and bad for workers:

Tax and fee hikes for city residents: Taxpayers are required to pay an additional $75 million into the Chicago Park District’s pension fund. The annual taxpayer contribution to the fund will also triple under this new legislation.

Forces workers to keep paying into a broken system: Chicago Park District workers will eventually be forced to pay 12% of their paycheck into the system, up from 9%.

Keeps retirement age too low: Private sector workers do not qualify for full Social Security benefits until age 67; the retirement age for the majority of Chicago Park District workers, under this bill, would be 58. Any pension reform bill must match the government retirement age to the private sector retirement age to fix the system.

The bottom line is that with today’s actions, lawmakers in Springfield cemented tax and fee increases on Chicago residents. They are continuing to paper over the city’s pension problem and refusing to tackle it head on.

Taxpayers deserve better, and Chicago Park District workers also deserve a retirement system that they can control instead of being forced to abide by the whims of politicians.