Illinois’ unpaid bills higher today than when lawmakers passed the 2011 tax hike

The Illinois General Assembly passed a record income tax increase on individuals and businesses in 2011. And Gov. Pat Quinn promised that it specifically was “designed to pay our bills.” By the end of the current fiscal year, lawmakers will have collected a total of $25.7 billion in new revenue from the 2011 tax hike....

The Illinois General Assembly passed a record income tax increase on individuals and businesses in 2011. And Gov. Pat Quinn promised that it specifically was “designed to pay our bills.”

By the end of the current fiscal year, lawmakers will have collected a total of $25.7 billion in new revenue from the 2011 tax hike. Despite this massive inflow of new cash, Illinois’ unpaid bills are higher today than they were when lawmakers passed the 2011 tax hike.

In April 2013, the backlog of unpaid bills stood at $8.5 billion and vendors were waiting at least four months for payments from the state. According to the State Journal-Register

“… as of late last week, the total was at $8.8 billion — an even higher number than at the start of April.

“Hahn said the office believes the total will hit $9 billion by the end of December, exactly where Topinka predicted it would be last summer. It is the second year in a row the backlog will sit at about $9 billion at the end of the calendar year.”

If Illinois sits on its multibillion-dollar backlog of bills long enough, taxpayers will have to pay a penalty.

Illinois is required by law to pay interest of 1 percent a month on its unpaid bills, also called invoices, when they become more than 90 days old.

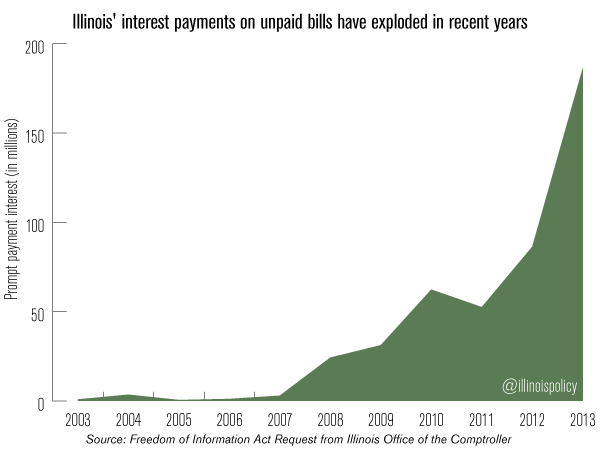

According to the Illinois comptroller, Illinois paid $186 million in interest payments on its unpaid bills in fiscal year 2013. That’s 215 times the $866,000 in interest payments paid by the state in fiscal year 2003.

This is a trend that taxpayers simply cannot afford. What’s more, it’s a tab they shouldn’t have to pick up in the first place.

The growing stack of unpaid bills and interest penalties are the result of Illinois’ decadeslong spending problem. Since 1990, state spending outpaced the growth in inflation and population by 3-to-1. And pushing taxes even higher to maintain this rapid growth in spending won’t solve the problem. Lawmakers should instead embrace the basics of good public policy – balancing the budget and reining in spending.