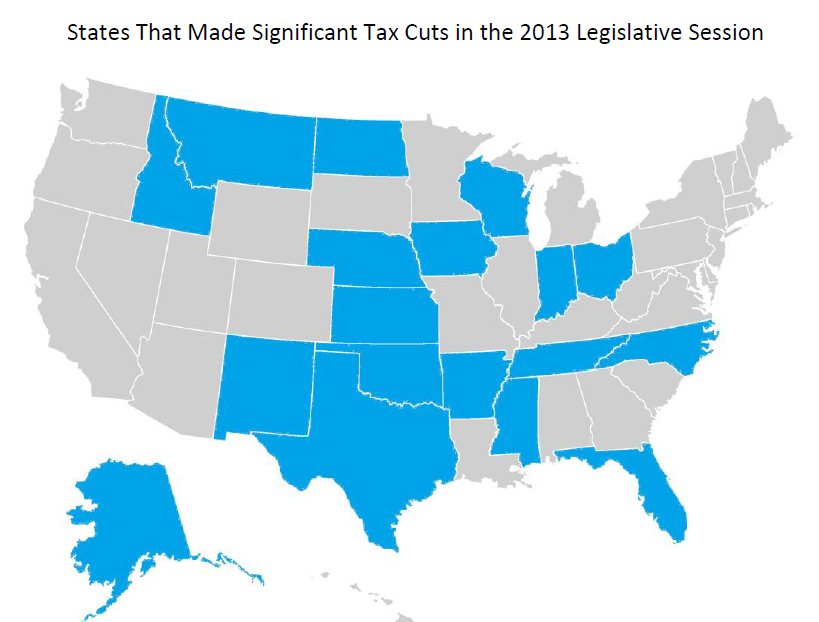

Illinois surrounded by states lowering tax rates

Eighteen states made pro-growth tax changes during the 2013 legislative session. In contrast, Illinois introduced two pieces of legislation that would increase the state’s income tax. The 18 states that cut taxes this year did so across more than two dozen categories. Notably, a third of those cuts were in the personal and corporate income tax...

Eighteen states made pro-growth tax changes during the 2013 legislative session.

In contrast, Illinois introduced two pieces of legislation that would increase the state’s income tax.

The 18 states that cut taxes this year did so across more than two dozen categories. Notably, a third of those cuts were in the personal and corporate income tax categories.

States are cutting income taxes to better compete in today’s modern economy, where capital and labor are becoming increasingly mobile. According to Ben Wilterdink:

“The data is clear: states with a lower tax burden are able to achieve higher rates of growth in almost every economic category. In the 2013 legislative session, 18 states received this message. If the remaining 32 states desire to stay competitive, it is best they follow their low-tax, pro-growth counterparts.”

But in Illinois, several special-interest groups and lawmakers in Illinois are pushing to swap out the state’s constitutionally protected flat-rate income tax for a progressive income tax.

One tax-hike plan was introduced by state Rep. Naomi Jakobsson, D-Champaign. The income tax rate in Illinois is legally required to sunset to 3.75 percent in 2015. Under Jakobsson’s plan a higher 4 percent marginal rate kicks in for people earning more than $18,000. Marginal rates increase again to 5 percent after $36,000, to 6 percent after $58,000 and again to 7 percent after $95,000. These rates attack Illinois’ working and middle classes.

In the private sector, if all fast food chains were increasing efficiencies and cutting prices while one restaurant did the opposite, that one restaurant would go out of businesses. Let’s hope Illinois doesn’t make that mistake.