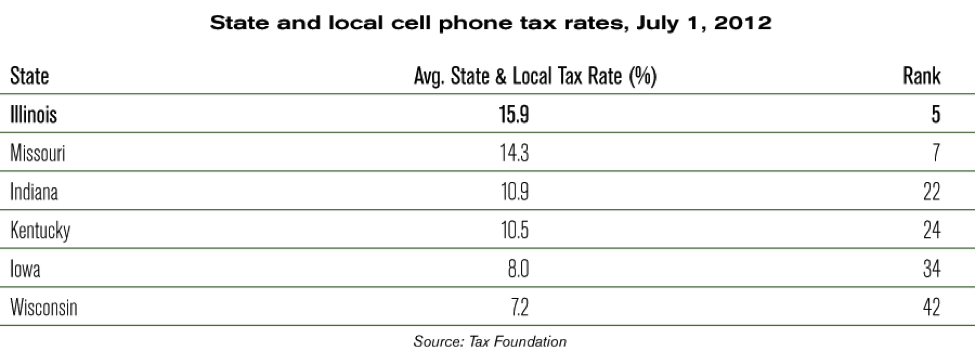

Illinois has the highest sales taxes of its neighbors

Illinois has high sales taxes. As of January 2013, Illinois had the 12th-highest combined state and average local sales tax rate in the country at 8.13 percent – higher than all bordering states. Chicago’s combined sales tax rate of 9.75 percent tied with Los Angeles as the highest sales tax among major U.S. metropolitan areas...

Illinois has high sales taxes.

As of January 2013, Illinois had the 12th-highest combined state and average local sales tax rate in the country at 8.13 percent – higher than all bordering states.

Chicago’s combined sales tax rate of 9.75 percent tied with Los Angeles as the highest sales tax among major U.S. metropolitan areas in 2010.

Such high rates push consumers and businesses to flee to nearby states to buy and sell, depressing state tax collections. Every transaction made in Wisconsin, Missouri or Indiana by an Illinois resident is one less revenue opportunity for Illinois.