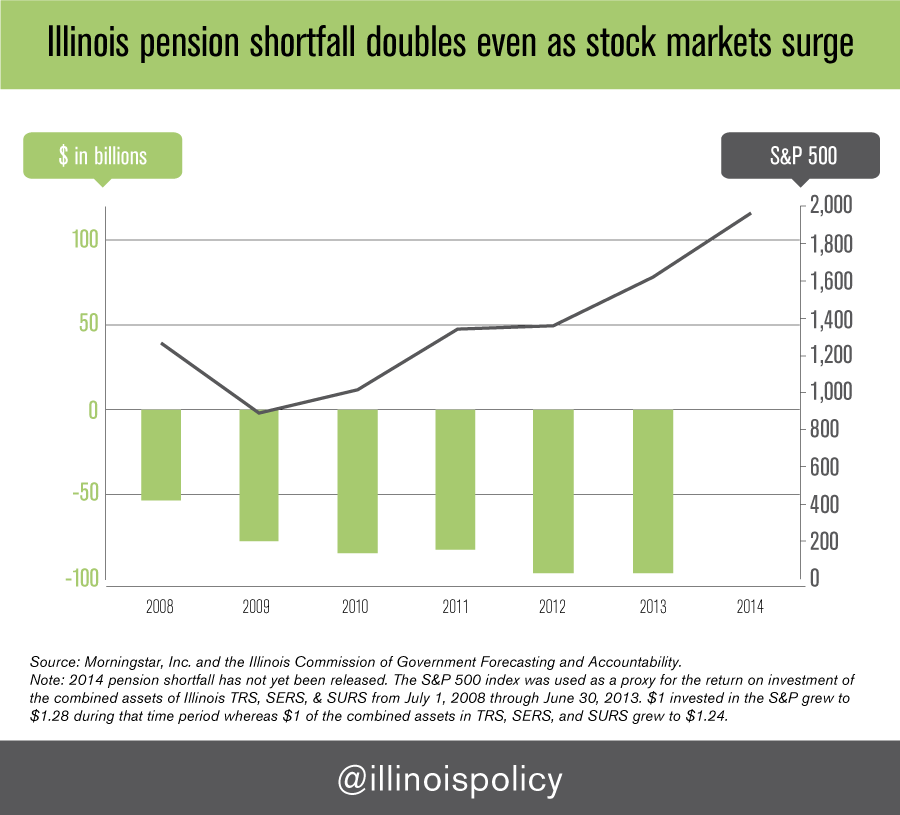

Government workers watch stock market boom as their retirement security collapses

Stock markets have reached all-time highs just a few years after the market meltdown of the Great Recession. The Standard & Poor’s 500 index has more than doubled since the end of 2008 and many individuals have replenished their retirement accounts, and then some. But if you’re an Illinois government worker stuck in a state-run...

Stock markets have reached all-time highs just a few years after the market meltdown of the Great Recession. The Standard & Poor’s 500 index has more than doubled since the end of 2008 and many individuals have replenished their retirement accounts, and then some.

But if you’re an Illinois government worker stuck in a state-run pension, you haven’t seen any benefits from the five-year market boom. In fact, your retirement security has collapsed.

The solvency of government-worker pension plans has worsened as those plans continue to rack up more debt. Illinois’ five state-run pension plans now have a gaping hole of $100 billion, nearly double what it was in 2008. The funds are so impaired that even historic stock-market returns haven’t helped plug that hole. The risk of government workers seeing their future pension benefits slashed is growing.

While most Illinois politicians agree that something needs to be done about the state’s pension crisis, many still oppose real reform like swapping out the traditional pension scheme for 401(k)-style plans. They say that 401(k)s are too risky and don’t offer the security of guaranteed pensions.

But being trapped in a pension system run by those same politicians is far more risky. The last five years tell the story – Illinois’ pension shortfall has nearly doubled since 2008 despite the following:

- All-time highs in the stock market

- More than $7 billion politicians borrowed from the bond market in 2009 and 2010 to put into the pension funds

- The massive tax hike of 2011, the majority of which went to fund pensions

Politicians have proven they can’t run government-worker retirements. Their continuous mismanagement and underfunding has made Illinois’ pension plans the worst funded in the nation. Politicians have even run their own pension plan, the General Assembly Retirement System, or GARS, into the ground. With just enough assets to pay benefits for the next 2.5 years, GARS is the worst-funded of the five state-run pension funds.

It’s not fair to make government workers dependent on politicians for their retirement security. Illinois workers have already seen what’s happened in Detroit, Pritchard, Ala., and Cedar Falls, R.I., where bankruptcies have slashed pension and retiree health-care benefits. No amount of legal protections or constitutional guarantees saved those government workers from the broken promises of politicians.

Government workers should control their own retirements through self-managed plans, much like those being introduced by states across the country – most recently in Oklahoma. There, new state workers will manage their own retirements through 401(k)-style plans beginning in 2015.

It’s time to follow the lead of other states and get politicians out of the retirement business.