Fitch Ratings: Chicago approaching “inflection point”

Triple-notch credit downgrades for government entities are supposed to be rare. They normally happen only in response to major financial events, such as a sudden fiscal emergency. But Chicago just received its second triple-notch downgrade in just six months. And that spells trouble for Chicago taxpayers. Citing skyrocketing pension costs and a lack of meaningful...

Triple-notch credit downgrades for government entities are supposed to be rare.

They normally happen only in response to major financial events, such as a sudden fiscal emergency.

But Chicago just received its second triple-notch downgrade in just six months. And that spells trouble for Chicago taxpayers.

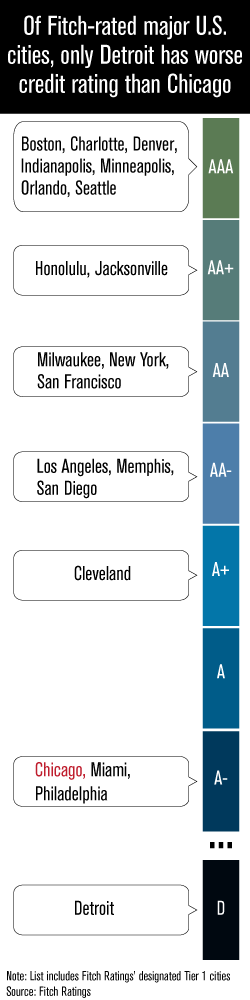

Citing skyrocketing pension costs and a lack of meaningful solutions, Fitch Ratings lowered the city of Chicago’s debt to A- from AA- last week. That’s just four notches away from junk-bond status.

Fitch’s downgrade comes on the heels of Moody’s Investors Service’s triple-notch downgrade of Chicago in July, prompted by the agency’s new methodology that nearly doubles the city’s official pension shortfall to $36 billion.

But Fitch didn’t just take Chicago’s credit rating down one notch — they hit Chicago with a triple-notch downgrade. Why?

Fitch Analyst Arlene Bohner said Chicago is approaching an “inflection point where inaction on pension reform will negatively impact the city’s finances and threaten to crowd out spending on city services.”

The city has already shuttered nearly 50 schools in the Chicago Public Schools system. And rather than hiring more police to battle crime, the city is resorting to paying overtime for existing officers. Chicago Mayor Rahm Emanuel has warned that property taxes will double if no real pension solution is found.

Fitch agrees. It says that if the city were to properly fund its pension system, city property taxes would “rise a dramatic 136%.”

So far, the Illinois General Assembly’s only response to the pension crisis was to pass a pension “fix” for the Chicago Park District. That fix calls for a tax hike on city residents, forces workers to keep paying into a broken system and does nothing to change the way the city runs retirements for its city workers.

Make no mistake: this bill is bad for city workers and taxpayers and will only perpetuate the problem.

There’s only one real way to change the rating agencies’ outlook on Chicago. And that’s to end defined benefit pensions and move to a system in which workers control their own retirements.