QUOTE OF THE DAY

WREX: Study outlines Rockford’s pension crisis

A city in crisis. That’s how one research group describes Rockford because of its pension problems. It gives the city a critical rating, and warns taxpayers aren’t the only ones feeling the impact.

“A lot of attention is being put on Chicago because Chicago is the super dangerous pension system in the state, but they’re pretty much ignoring what’s happening in the municipal level,” said Ted Dabrowski with the Illinois Policy Institute.

What’s happening in Rockford, according to Dabrowski, is the pension system is failing.

Daily Herald: Suburbs would pay more under graduated income tax

A growing campaign for a graduated income tax in Illinois could push more of the total tax burden onto some areas of the suburbs, where median incomes far outpace state averages, critics say.

Some Democrats support a plan to ditch Illinois’ 5 percent flat income tax rate and replace it with tax rates that would vary depending on income. People who make more money would have higher tax rates, which supporters say is more fair than the current system.

The plan would require amending the state constitution and new rates wouldn’t be set until afterward, so there’s no way to know yet how people of varying incomes would be affected by a tax change.

Reuters: Illinois, Chicago set bond sales for debt-hungry market

Illinois and its biggest city, Chicago, will head to the supply-starved U.S. municipal bond market this month to sell more than $800 million of debt.

The state has set a $402 million competitive sale of taxable Build Illinois sales tax revenue bonds for March 11, according to the deal’s preliminary official statement.

Chicago will sell $405 million of general obligation bonds through Wells Fargo Securities next week, a market source familiar with the deal said.

WGN: Chicago gas prices surge; highest prices in months

Gas prices in Chicago are at their highest prices in the last six months and some experts said they show no signs of going down anytime soon.

The surge has hit drivers at the pump especially hard in the last 30 days.

The average price for a gallon of regular unleaded in Chicago and the surrounding suburbs is $3.89.

AEI: Is America really going to accept a permanent economic slowdown?

From 1948 through 2007, the US economy grew by an average of 3.4% a year, adjusted for inflation. Real GDP grew by 3.1% in the 1950s, 4.5% in the 1960s, 3.2% in the 1970s, 3.4% in the 1980s, 3.9% in the 1990s, and 1.7% in the 2000s. Now the decades don’t match up perfectly with business cycles, but you get the picture.

The new Obama budget, however, accepts a “new normal” growth potential of just 2.3%. Its new economic forecast sees growth accelerating over the next few years, GDP expanding by 3.4% in 2015, 3.3% in 2016, 3.2% in 2017 and 2.6% in 2018. But starting in 2021, the White House just inserts its estimate of long-term GDP potential of 2.3% for its forecast.

As Team Obama explained last year:

In the 21st Century, real GDP growth in the United States is likely to be permanently slower than it was in earlier eras because of a slowdown in labor force growth initially due to the retirement of the post-World War II baby boom generation, and later due to a decline in the growth of the working age population.

Daily Herald: Detroit to pay $77 million in accord with UBS, Merrill Lynch

Detroit agreed to pay $77.6 million to UBS AG and Bank of America Corp.’s Merrill Lynch unit to end interest-rate swaps that have cost taxpayers more than $200 million since 2009, according to a court filing in the city’s bankruptcy.

The settlement, which is a 70 percent reduction in the amount the city was liable for under the 2009 agreement, will release Detroit from claims by the banks and provide “greater certainty with respect to the city’s cash flows and liquidity,” Detroit’s attorneys said in a filing yesterday seeking approval for the accord from U.S. Bankruptcy Judge Steven Rhodes. The payments will be made over time, rather than in a lump sum, the lawyers said.

“The settlement also contains an agreement by the swap counterparties to vote their impaired claims in favor of a plan of adjustment,” the city said in the filing.

SJR: AFSCME makes new push for back wages

Despite warnings that more than $2.3 billion must be cut from next year’s state budget, the largest state employee union is renewing its call for money to be set aside to pay back wages owed to union workers.

The American Federation of State, County and Municipal Employees is again calling on lawmakers to approve one of the bills pending that would allocate $112 million to pay the wages owed to workers from as far back as 2011.

AFSCME has begun calculating how much is owed to workers in various parts of the state based on the number of workers in legislative districts. In the Springfield area, AFSCME says more than $17 million is owed to about 4,600 unionized state workers who did not get raises owed to them under previous union contracts.

The Mark-Up: A Middle Ground in the Pension Wars

Pensions are in the news these days, as the retirement benefits of our nation’s hard-working public employees are being squeezed by economic realities and mismanagement by politicians. The most notable example of the danger posed by an underfunded pension system is Detroit, where in December a federal judge ruled that pension promises will not be protected during bankruptcy proceedings. Puerto Rico also has serious fiscal problems, and, despite attempts to reform its pension systems, the island’s debt was downgraded to junk status earlier this month by the major rating agencies.

These examples are extreme, but even more typical cases are unsettling given the roughly $2.7 trillion pension hole that states have to dig out of — a hole that continues to deepen in many places. In the absence of new revenue sources, ballooning pension obligations are likely to crowd out other vital public services, such as education. For example, a recent analysis found that Milwaukee Public Schools face increasing pension costs that, without additional funding, could require the district to fire 24 percent of its teachers or cut their salaries and benefits by the same amount between now and 2020.

After years of failing to make adequate payments to public pension systems, politicians are finally starting to act. The resulting policies, such as reductions in benefits and shifts to the 401(k)-style plans common in the private sector, have been defended as necessary by reform proponents and attacked by public-sector employees and their unions as draconian and unfair.

Daily Beast: Why Is Progressive Hero Bill de Blasio Throwing Charter Schools Out of New York City?

When does a local education fight become a national bellwether? When it touches a policy lightning rod, scrambles partisan allegiances, and involves political actors who stand in for whole political ideologies.

And, sure, it helps when the locale staging the fight is New York City.

New mayor Bill de Blasio made waves last Thursday when his administration withdrew three agreements that would have allowed public charter schools to share space with district schools in public school buildings. The affected schools are all part of the Success Academy network of schools, which was founded by Eva Moskowitz, a former New York City councilmember. These “co-location” agreements were approved last October, under previous mayor Michael Bloomberg’s administration.

CNN Money: Moody’s downgrades Chicago amid pension crisis

Moody’s Investors Service rating agency downgraded Chicago’s creditworthiness Tuesday, citing the city’s “massive and growing” pension hole.

After years of avoiding the issue, the city of Chicago is facing a massive spike in its annual bill for the pensions it promised current and retired workers. Next year, the city’s required contribution will more than double to $1.07 billion.

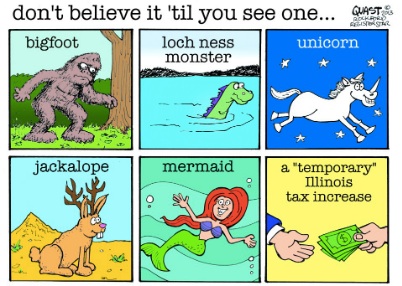

CARTOON OF THE DAY