QUOTE OF THE DAY

WSJ: U.S. Second-Quarter GDP Expands at 4.0% Rate

The U.S. economy rebounded strongly this spring after a first-quarter contraction, eking out positive growth over the past six months and raising hopes for sustained growth in the second half of 2014.

Gross domestic product, the broadest measure of goods and services produced across the economy, advanced at a seasonally adjusted annual rate of 4.0% in the second quarter, the Commerce Department said Wednesday. Economists surveyed by The Wall Street Journal had forecast growth at a 3.0% pace for the quarter.

An upturn in inventory building and an acceleration in consumer spending led the broad gains and offset a larger drag from increased imports.

Chicago Tribune: ‘Millionaire tax’ question to appear on fall ballot

Gov. Pat Quinn today signed into law a measure to put a non-binding referendum on the fall ballot asking voters whether millionaires should be taxed at a higher rate — a move aimed at helping drive up Democratic turnout.

The measure represents a Plan B for Quinn, who had supported efforts initiated by Democratic House Speaker Michael Madigan to have a binding constitutional amendment placed on the ballot to require millionaire incomes to pay an additional 3 percentage points above the current individual income tax rate. That plan went nowhere in the General Assembly.

The ballot proposal signed by Quinn at a Berwyn elementary school asks voters if they think the constitution should be amended to give schools, based on their student population, money from a 3 percent tax on millionaire incomes. The state Revenue Department said such a tax would generate about $1 billion. It would not have the force of law, however.

Huffington Post: Illinois Turbulent Love Affair With Government Entities

Illinoisans have a reluctant love affair — or perhaps an unhappy arranged marriage — with government. With more than 8,400 government taxing bodies, Illinois tops the nation. The city of Chicago on its own has almost 2,000 units of government. There is a government entity for nearly every part of civic life.

No other state comes remotely close to Illinois’ tally for government taxing bodies.

If you are a Chicagoan, name every position and person who you elect to the city council, the Illinois House and Senate, Congress, the Cook County Board of Commissioners, Cook County-wide offices, the Board of Review, and the Metropolitan Water Reclamation District. If you are in the suburbs, add to this list your school board or boards, the community college board, the library board, the park district board, the township, and maybe one or two other special districts.

Chicago Sun Times: Chicago Teachers Union, progressives form new Chicago coalition

Look out Chicago, a new political movement has arrived.

United Working Families, a partnership between labor groups, including the Chicago Teachers Union, and a coalition of a dozen community groups is expected to announce its formal launch on Monday, executive director Kristen Crowell tells Early & Often.

Crowell is the same woman who headed an effort to counter policies by Wisconsin Republican Gov. Scott Walker, raising $50 million along the way.

Yahoo Finance: 22M young adults live at home: New survey says parents don’t mind

More and more young adults are choosing to live at home with their families than buy a home. About 22 million adults between the ages of 18-34 lived at home in 2013 — a 4% increase from 2006. Parents are welcoming these late (housing) bloomers with open arms: 68% would prefer if their adult child continues to live with them according to a new study by Fannie Mae.

Doug Duncan, chief economist at Fannie Mae, says there are several financial reasons young adults are reluctant to move out. Some want to shore up their finances before getting married; others are working in low-wage jobs; some are choosing to graduate later from college and are living at home to reduce expenses.

This trend has had a big impact on the housing market. Analysts say that the housing recovery has stalled in part because of the lack of demand by new home buyers.

U.S. News: Obama’s Misleading Minimum Wage Statistics

Earlier this month, President Obama seized upon fresh data from the Labor Department to argue for a higher minimum wage. According to the president and a subsequent Associated Press report, the 13 states that raised their minimum wages in January of this year are now enjoying, on average, faster job growth than the other 37 states.

The conclusion that Obama (and each of the many media outlets that breathlessly repeated this finding) wants us to draw is that a higher minimum wage not only does not price some workers out of jobs, it positively enhances workers’ job prospects. As the president theorized, “When … you raise the minimum wage, you give a bigger chance to folks who are climbing the ladder, working hard.”

Not so fast.

Wall Street Journal: Liberals Love the ‘One Percent’

Federal Reserve Chair Janet Yellen has said the central bank’s goal is “to help Main Street not Wall Street,” and many liberal commentators seem convinced that she is advancing that goal. But talk to anyone on Wall Street. If they are being frank, they’ll admit that the Fed’s loose monetary policy has been one of the biggest contributors to their returns over the past five years. Unwittingly, it seems, liberals who support the Fed are defending policies that boost the wealth of the wealthy but do nothing to reduce inequality.

This perverse outcome is not the Fed’s intent. It has kept interest rates near zero in an effort to combat the great recession of 2008-09 and nurse the weak economy back to health. Many analysts will argue that the recovery might have been even worse without the Fed’s efforts. Still, the U.S. economy has staged its weakest recovery since World War II, with output up a total of just 10 percentage points over the past five years. Meanwhile, the stock market has never been so high at this point in a recovery. This is the most powerful post-recession bull market in postwar history, with the stock market up by a record 135% over the past five years.

The Fed can print as much money as it wants, but it can’t control where it goes, and much of it is finding its way into financial assets. On many long-term metrics, the stock market is now at levels that fall within the top 10% of valuations recorded over the past 100 years. The rally in the fixed-income market too is reaching giddy proportions, particularly for high-yield junk bonds, which are up 150% since 2009.

Chicago Tribune: Boost the economy. Create jobs. Fix the tax code.

In coming weeks, Walgreen Co. is expected to decide whether it will proceed with the purchase of a big European drugstore chain. That deal would enable Walgreen to relocate from north suburban Deerfield to Europe, where it would pay a lower tax rate.

Walgreen is one of several prominent American companies laying plans to cut their tax bills by moving their headquarters abroad. In these “inversions,” as they’re called, U.S. corporations merge with partners in foreign countries, which they then call home. Inversions aren’t new, but a recent wave of transactions has prompted a call to action on Capitol Hill — and a few cheap shots too.

U.S. Sen Dick Durbin of Illinois, Treasury Secretary Jack Lew and other Democrats have bashed the companies involved for their supposed lack of “economic patriotism.” President Barack Obama last week scolded the companies for being “corporate deserters who renounce their citizenship to shield profits.” Speaking about the economy at a trade school in Los Angeles, the president said, “My attitude is, I don’t care if it’s legal. It’s wrong.”

Real Time Economics: Best and Worst Cities for Delinquent Debt, from Texas to Minnesota

Cities in the southeastern U.S. have the biggest share of consumers with unpaid debt, a new report says.

The Urban Institute, a Washington-based think tank, published a detailed report on Tuesday on the level of delinquent debt around the country. (See related post on the WSJ Numbers blog).

The report, based on an analysis of 2013 data from credit reporting firm TransUnion, is an indication that many parts of the country are still struggling with the aftermath of the recession.

The Hill: Medicare, Social Security march toward insolvency

Social Security and Medicare are marching steadily toward insolvency, according to a report released Monday by the trustees for the two entitlement programs.

While the report found some improvement for Medicare, which will now be able to meet its obligations until 2030, four years later than projected a year ago, the overall message continued to paint a dire long-term picture for the two programs.

Both will come under more strain amid a flood of retirees in the coming years, the trustees said. And the pressure will grow as Washington’s attention has turned away from any debate over changing the programs.

Chicago Sun Times: Chicago telephone tax to rise by 56 percent to shore up pensions

Desperate to avoid a pre-election property tax increase, Chicago aldermen advanced an alternative Tuesday that could end up costing their constituents even more money: a 56 percent increase in the monthly surcharge tacked on to telephone bills.

Effective Sept. 1, the City Council’s Finance Committee agreed to raise the surcharge from $2.50 to $3.90–$1.40 more-per-month or $16.80-a-year–for every land line and cell phone in Chicago. The tax applied to pre-paid phones will rise from 7-to-9 percent, effective Oct. 1.

A family of four with four cell phones and a land-line would end up paying $84 in additional taxes each year. That’s $34-per-year more than the $50 price of Mayor Rahm Emanuel’s original plan to raise property taxes by $250 million over a five-year period to shore up two of Chicago’s four city employee pension funds.

Seattle Post-Intelligencer: Beach town’s ban prompts battle over shave ice

A $3 cup of shave ice is at the center of a dispute in this beach town between street vendors trying to stay in business and town officials who say the vendors cause traffic congestion and increase the potential for accidents.

George Manko sells Hawaiian shave ice in a private parking lot for beachgoers in Westerly, where celebrities including Taylor Swift and Conan O’Brien have summer homes.

The town recently banned street vendors, except for at festivals and one-time events. Town councilors who supported the ban said they did so because the police chief expressed safety concerns.

My Stateline: Fed Up With Corporate Tax Loopholes, Durbin Unveils New Bill

Following a move by Springfield-based Walgreen’s – U.S. Sen. Dick Durbin (D) unveils bill to close corporate tax loopholes.

Durbin, along with several democratic congressional members, introduced the No Federal Contracts for Corporate Deserters Act. If passed, it would ban the government from doing business with American companies trying to avoid taxes by setting up their headquarters overseas. Walgreen’s recently announced they’re considering moving to Europe.

“The tax burden increases on the rest of us to pay what the corporate inverter doesn’t” says Durbin. “The burden is made worse by allowing companies to proift off of federal contracts paid for by U.S. taxpayers, while those very companies run from the U.S. tax responsibility. We should make permanent the long-standing ban on federal contracts for corporations that have renounced their American corporate citizenship.”

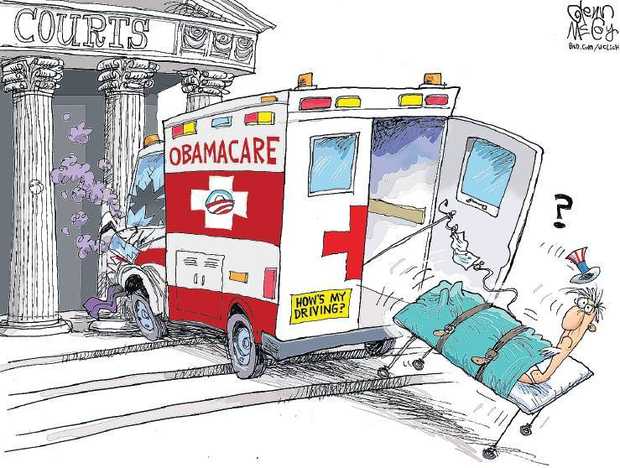

CARTOON OF THE DAY