Chicago property taxes: Rahm’s hikes vs. Quinn’s relief

Gov. Pat Quinn is in a bind. He’s being asked to sign a Chicago pension bill that he knows has no real reforms and no way to pay for itself. By signing the bill, Quinn will give Mayor Rahm Emanuel his blessing to raise Chicago property taxes by $750 million over five years. But that’s...

Gov. Pat Quinn is in a bind.

He’s being asked to sign a Chicago pension bill that he knows has no real reforms and no way to pay for itself. By signing the bill, Quinn will give Mayor Rahm Emanuel his blessing to raise Chicago property taxes by $750 million over five years.

But that’s just the beginning.

If the Legislature uses the same blueprint to “fix” the city and Cook County’s other pension funds, Quinn will be blessing billions more in tax hikes.

The problem for Quinn is that he promised property tax relief to all Illinoisans in his state budget address just two weeks ago. Here’s what he said:

“My comprehensive tax reform plan starts with providing every homeowner in Illinois with a guaranteed $500 property tax refund every year.

In Illinois, more is collected in property taxes every year than in the state income tax and state sales tax combined. In fact, Illinois has one of the highest property tax burdens on homeowners in the nation – more than 20 percent above the national average. The property tax is not based on ability to pay. The property tax is a complicated, unfair tax, hitting middle-class families the hardest.

For too long, Illinois has … overburdened its property taxpayers.”

By signing a pension bill that helps Emanuel raise property taxes, Quinn will break yet another promise. The governor has already asked the Legislature to make the 2011 tax hike permanent, even though he originally promised it would be temporary.

But Quinn has a way out of his predicament. Besides the obvious political reasons to oppose the bill, Quinn has three good policy reasons not to sign it.

1) Property tax hikes won’t solve Chicago’s pension problem. Emanuel needs more taxes because his plan doesn’t reform the broken pension system. Instead, it just props up a failed system run by the same politicians who bankrupted it in the first place.

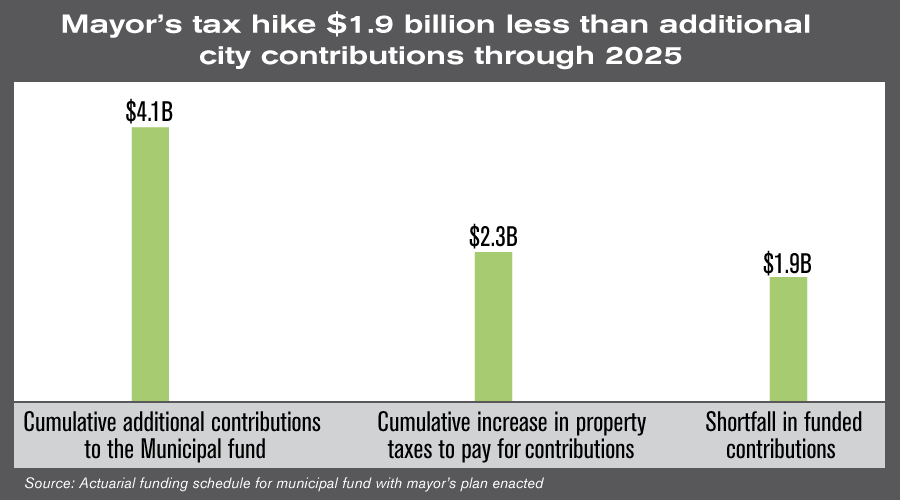

What Emanuel and supporters of his pension bill won’t tell you is that they’ll be back for even more tax hikes. Emanuel’s current plan calls for additional city contributions (above what the city pays today) to the municipal pension fund totaling $4.1 billion through 2025. But his proposed property tax hikes will raise only an additional $2.25 billion during that time period.

That means the mayor’s tax hike will be $1.9 billion short of the extra contributions needed through 2025. Without real reforms, he’ll be back for more.

2) People and businesses will flee. Avoiding real reforms and raising taxes is a failed strategy. People and businesses will flee Chicago, just as they’ve been doing for years. Taxpayers will leave because they’ll be paying more money for fewer services.

Each Chicago household is already on the hook for more than $61,000 in future taxes to pay down the massive long-term debt – more than $63 billion in bonds and pension shortfalls – that their city and county governments have racked up.

Tax hikes mean fewer people will stick around to pay a growing bill.

3) There is a plan to fix Chicago without tax hikes. The Illinois Policy Institute offers a reform plan that avoids tax hikes and immediately cuts Chicago’s pension shortfall in half. The core of its solution is a hybrid retirement plan for city workers that gives them a self-managed plan and fixed, monthly Social Security-like benefits at retirement.

The plan makes the tough choices necessary to bring about real retirement security for Chicago’s city workers.

Quinn and Emanuel’s goal must be to end Chicago’s pension crisis and to preserve Chicago’s status as a world-class city.

Massive property tax hikes will do just the opposite and push Chicago further in the direction of Detroit.