Chicago pension debt grows despite high market returns

The city of Chicago’s four government-run pension funds each beat their expected investment returns in 2013, according their most recent financial reports. Yet the city’s unfunded pension debt grew by nearly $800 million. The assumed investment return for the city’s four pension funds ranges from 7.5-8 percent. Yet the 2013 investment returns were 13 percent...

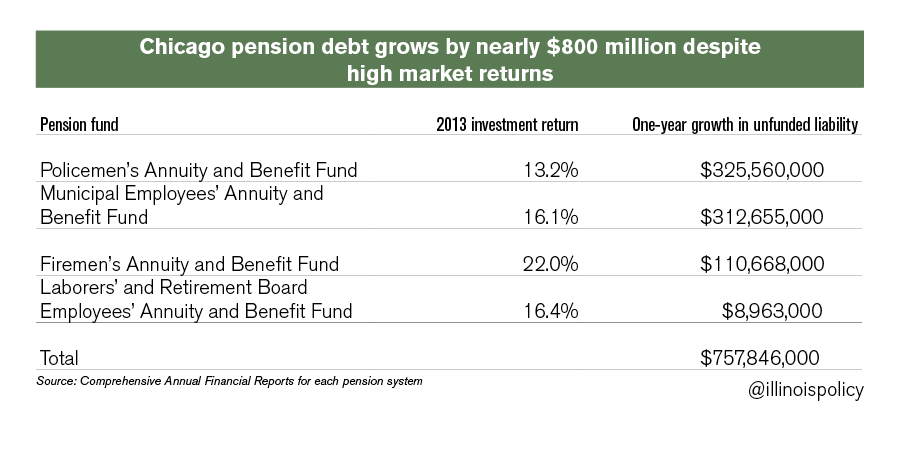

The city of Chicago’s four government-run pension funds each beat their expected investment returns in 2013, according their most recent financial reports. Yet the city’s unfunded pension debt grew by nearly $800 million.

The assumed investment return for the city’s four pension funds ranges from 7.5-8 percent. Yet the 2013 investment returns were 13 percent for the police fund,16 percent for municipal employees and laborers, and 22 percent for the firefighters – nearly triple the assumed rate of return.

Despite the higher-than-expected market returns, the city’s funding ratio dropped to 34 percent from 35 percent. And the city’s unfunded pension debt grew by nearly $800 million.

With only 34 cents for every dollar the city should have today to pay future pension benefits, the retirement security of government workers is at risk.

So how does this happen?

The pension systems are so underfunded – missing more than $19 billion today – that even high returns didn’t help the funding situation. High investment returns only go so far in a system that has only a third of the assets it’s supposed to have in the bank today.

The problem is that politicians made false promises and mismanaged government worker pensions for decades. Even Chicago’s own financial documents acknowledge the city’s contributions fell far short of covering future benefit payments and that politicians have not taken the actions necessary to address the city’s growing pension problems.

Now the city’s pension systems are on the brink of collapse.

It’s time to take politicians out of the retirement business and give government workers control over their own retirement futures.