Chicago gas prices $0.53 higher than national average

Just as travelers prepare to hit the road to celebrate Independence Day weekend, national gas prices have risen to levels not seen since 2008. And though prices have dropped slightly in Chicago, the price for a gallon of gas is still higher than it was last year, according to AAA. Today, the average price per...

Just as travelers prepare to hit the road to celebrate Independence Day weekend, national gas prices have risen to levels not seen since 2008.

And though prices have dropped slightly in Chicago, the price for a gallon of gas is still higher than it was last year, according to AAA. Today, the average price per gallon in Chicago is $4.21, down from $4.25 last week – last year’s average price per gallon was $4.12.

And while some may hail Chicago’s recent price dip as a good sign, the truth is that gas still costs $0.53 more there than the national average of $3.68.

One of the major reasons why the city’s prices are so high is Illinois’ additional gas sales tax burden.

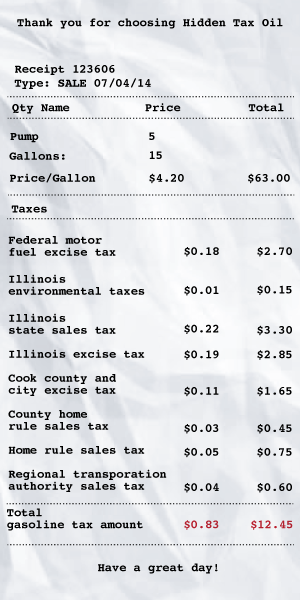

Traditional gas taxes such as “motor fuel taxes” are a fixed amount per gallon. These taxes generally pay for road maintenance and other transportation expenses – and motorists in all states pay these taxes. Combined, the federal, state, county and Chicago motor fuel taxes total $0.83 per gallon at today’s price. That leaves the raw price per gallon at $3.39.

But not only does Illinois have the nation’s fifth-highest state excise tax rates, it also is one of only seven states to apply an additional sales tax onto gas purchases.

These taxes don’t show up on your receipt. They’re hidden by being built into the price per gallon advertised along the roadways. Even worse, unlike the motor fuel taxes, the sales taxes are set as percentage rates.

As the price of gas goes up in Illinois, so does the amount you pay in taxes.

These additional taxes tack on $0.34 per gallon.

The state’s 6.25 percent sales tax adds $0.22 per gallon to the price of gasoline in Chicago. The county and city sales taxes add an additional $0.11 per gallon.

And unlike most states, whose gas-tax dollars fund roads and transportation services, the revenue generated by state sales taxes goes to the state’s general fund. That means Illinois is pouring gas-tax dollars into all sorts of government spending, including pensions and human services.