Champaign County breaks promise on sales-tax hike

Property taxes for school districts in Champaign County have risen substantially, despite property-tax relief promises made regarding the County School Facility Sales Tax enacted in 2009. And there’s reason to believe districts across the state might suffer the same fate. In April 2009, Champaign County passed a referendum for a 1 percent increase in the...

Property taxes for school districts in Champaign County have risen substantially, despite property-tax relief promises made regarding the County School Facility Sales Tax enacted in 2009. And there’s reason to believe districts across the state might suffer the same fate.

In April 2009, Champaign County passed a referendum for a 1 percent increase in the sales tax rate. The revenue from the tax increase went toward school facility projects and paying off bonds. School districts started receiving these new revenues in April 2010.

Before the referendum passed, each of the school districts in the county made plans for how the tax money would affect their community. These plans included goals that would benefit residents, such as providing property-tax relief to the area.

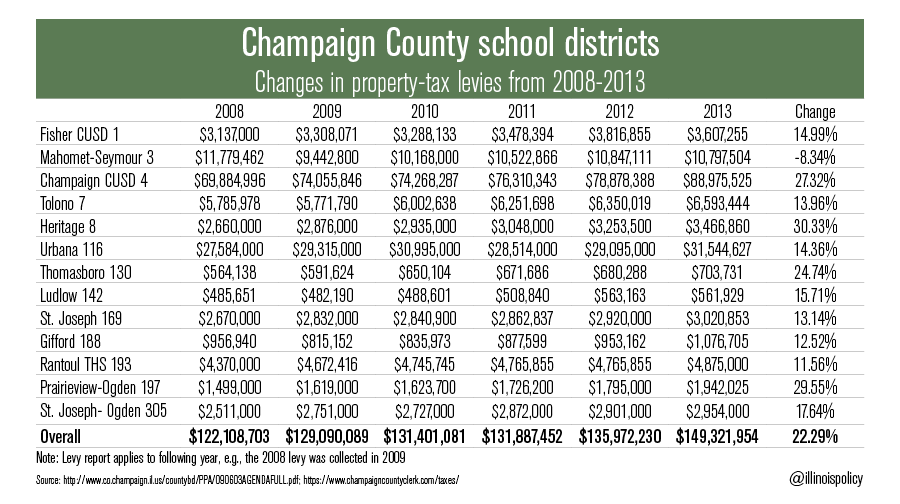

These promises of property-tax relief led voters to believe that the 1 percent sales tax would result in lower property taxes in the future. But since 2008, tax levies in 12 of the 13 school districts where similar promises were made have increased substantially. The total tax levy for all of the districts combined rose by 22 percent over that period.

Champaign residents paid an extra $27 million in property taxes last year, not to mention the cost of the 1 percent sales tax itself, which is estimated to bring in $16 million annually.

Heritage Community Unit School District #8 passed the largest hike, with the tax levy going up by 30 percent. Like many of the other Champaign County schools, the district’s plan promised that the facility sales tax would help reduce property taxes.

The only district where the tax levy went down was Mahomet-Seymour Community Unit School District #3. The district, which planned to spend a third of the sales tax revenue on reducing property taxes, lowered their levy by more than 8 percent.

Fourteen counties will have the same county school facility tax referendum on the ballot this November as Champaign County did in 2009. The school districts in these counties are providing information with similar claims about the sales-tax hike helping to lower property taxes.

However, as was the case in Champaign County, there’s no legal mechanism ensuring the sales-tax increase will be used for property-tax relief.

The campaign efforts for the tax hike in Champaign County were coordinated by Stifel, Nicolaus & Company, a Missouri-based financial conglomerate. Stifel is also involved with the school districts in many of the counties looking to pass the sales tax referendum in the upcoming election.