Allegheny Technologies to modernize retirement benefits with 401(k)-style plan

Allegheny Technologies is making the switch to a 401(k)-style plan despite the fact that the company’s defined-benefit plan is currently 87 percent funded. Regardless of how well funded some defined-benefit plans can be, the plans are no longer affordable or sustainable.

Allegheny Technologies is one of many companies choosing to abandon expensive, unpredictable defined-benefit retirement plans in favor of 401(k)-style plans, giving workers more control and ownership over their retirements.

According to Pensions & Investments:

“Allegheny Technologies Inc., Pittsburgh, announced on Friday it will freeze the benefit accruals of certain participants in its U.S. defined benefit plan on Dec. 31, spokesman Dan Greenfield said.

“An 8-K filing with the Securities and Exchange Commission notes ‘a consistent defined contribution plan with a base 6.5% company contribution and up to 3% in company matching contributions’ will be offered beginning Jan. 1. Mr. Greenfield said the freeze will affect only certain participants to align them with other employees who are already in the defined contribution plan, which had $989 million as of Sept. 30, 2013, according to Pensions & Investments’ data.”

The specialty metal company is doing what businesses across America have been doing for decades – moving from defined-benefit pensions to defined-contribution plans like 401(k)s. In 1985, only 1 in 10 Fortune 100 companies offered 401(k)-style plans to new employees. Today, that number has increased to 7 in 10.

Allegheny Technologies is making the switch to a 401(k)-style plan despite the fact that the company’s defined-benefit plan is currently 87 percent funded. Regardless of how well funded some defined-benefit plans can be, the plans are no longer affordable or sustainable.

That’s especially true for government-run pension funds. Today, Illinois’ five state-run pension funds have just 39 cents for every dollar they should have in the bank to pay for future benefits. That’s less than half the funding ratio of Allegheny Technologies’ pension fund.

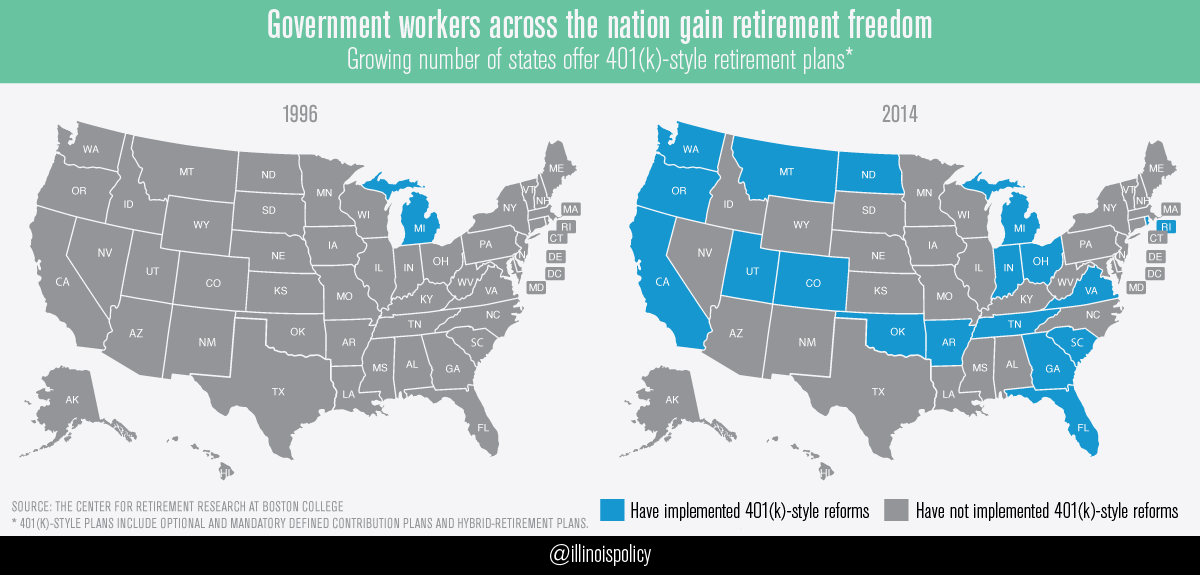

Illinois government should have followed the lead of the private sector long ago by moving to 401(k)-style plans. Other states certainly have. In 1997, Michigan froze the state employees’ defined-benefit pension plan and created a self-managed, 401(k)-style retirement plan for new state employees. Alaska followed suit in 2005. And Oklahoma in 2014.

Allegheny Technologies’ transition to 401(k)-style plans is a continuation of the modernization of retirement plans across the country. Expect more states and companies to follow that trend.